Tuesday, July 28, 2009

Climate Change

I think those who deny will say it's "global climate change", not "warming", then wring their hands and say "nothing can be done" -- this after its too late to do much of anything. Once again, I'm happy to be 70 years old, I might just miss most of the chaos that's coming.

Climate change to force 75 million Pacific Islanders from their homes

More than 75 million people living on Pacific islands will have to relocate by 2050 because of the effects of climate change, Oxfam has warned.

By Bonnie Malkin in Sydney

Published: 5:48AM BST 27 Jul 2009

A report by the charity said Pacific Islanders were already feeling the effects of global warming, including food and water shortages, rising cases of malaria and more frequent flooding and storms. Some had already been forced from their homes and the number of displaced people was rising, it warned.

"The Future is Here: Climate Change in the Pacific" predicted that many Pacific Islanders would not be able to relocate within their own countries and would become international refugees.

It urged neighbouring wealthy countries to take urgent action to curb their carbon emissions to prevent a large-scale crisis.

Half of the population of the Pacific live less than 1.5km from the coast and are incredibly vulnerable to sea-level rise and extreme weather. But as well as moving out, the report found that some countries had started adapting to the changing climate.

Fiji is attempting to "climate-proof" its villages by testing salt-resistant varieties of staple foods, planting mangroves and native grasses to halt coastal erosion in order to protect wells from salt water intrusion, and moving homes and community buildings away from vulnerable coastlines.

In the Solomon Islands officials are looking for land to resettle people from low-lying outer atolls, and those living in the outer atolls of the Federated States of Micronesia were also moving to higher ground. The tiny nation of Tuvalu also recently pledged to become carbon neutral by 2020.

Andrew Hewett, Oxfam Australia Executive Director, said it was vital that Australia started working with Pacific governments to plan for the impact of climate change.

As the wealthiest country in the region and the highest per capita polluter, Australia "must prevent further climate damage to the Pacific by urgently adopting higher targets" - reducing emissions by at least 40 per cent on 1990 levels by 2020 - and urging other developed countries to do the same, the report said.

The Australian government's commitment of $150 million (£75m) to help Pacific Islanders adapt to climate change needed to at least double, it said.

"It would be in Australia's interests to act now because, as the situation worsened, it would be called on to respond to more emergencies in the region," Mr Hewett told the Sydney Morning Herald.

With only months to go until the crucial UN negotiations in Copenhagen in December, Australia needed to show Pacific leaders it was willing to do its fair share to address one of the most pressing challenges in the region, he said.

"People are already leaving their homes because of climate change, with projections that 75 million people in the Asia-Pacific region will be forced to relocate by 2050 if climate change continues unabated. Not all will have the option of relocating within their own country, so it's vital that the Australian Government starts working with Pacific governments to plan for this now."

Pacific leaders will raise the issue of climate change with Kevin Rudd, the Australian prime minister, at the Pacific Islands Forum on Aug 4.

Saturday, July 25, 2009

I'd bet folks with money in any of those banks are rather happy the dreaded Federal Government is around to insure their losses.

I wonder where their "rugged individualism", "sink or swim on your own merits, own judgement" arguments are now?

Press Releases

Evans Bank, National Association, Angola, New York, Assumes All of the Deposits of Waterford Village Bank, Clarence, New York

FOR IMMEDIATE RELEASE

July 24, 2009

Media Contact:

David Barr

Office Phone: (202) 898-6992

Cell Phone: (703) 622-4790

Email: dbarr@fdic.gov

Waterford Village Bank, Clarence, New York, was closed today by the New York State Banking Department, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Evans Bank, N.A., Angola, New York, to assume all of the deposits of Waterford Village Bank.

The single office of Waterford Village Bank will reopen on Monday as a branch of Evans Bank, N.A. Depositors of Waterford Village Bank will automatically become depositors of Evans Bank, N.A. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship to retain their deposit insurance coverage. Customers should continue to use the existing branch until Evans Bank, N.A. can fully integrate the deposit records of Waterford Village Bank.

Over the weekend, depositors of Waterford Village Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of March 31, 2009, Waterford Village Bank had total assets of $61.4 million and total deposits of approximately $58 million. In addition to assuming all of the deposits of the failed bank, Evans Bank, N.A. agreed to purchase essentially all of the assets.

The FDIC and Evans Bank, N.A. entered into a loss-share transaction on approximately $56 million of Waterford Village Bank's assets. Evans Bank, N.A. will share in the losses on the asset pools covered under the loss-share agreement. The loss-sharing arrangement is projected to maximize returns on the assets covered by keeping them in the private sector. The agreement also is expected to minimize disruptions for loan customers.

Customers who have questions about today's transaction can call the FDIC toll-free at 1-800-323-6111. The phone number will be operational this evening until 9:00 p.m., Eastern Daylight Time (EDT); on Friday and Saturday from 9:00 a.m. to 6:00 p.m., EDT; on Sunday from noon to 6:00 p.m., EDT; and thereafter from 8:00 a.m. to 8:00 p.m., EDT. Interested parties can also visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/waterford.html.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $5.6 million. Evans Bank, N.A.'s acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Waterford Village Bank is the 58th FDIC-insured institution to fail in the nation this year, and the first in New York. The last FDIC-insured institution to be closed in the state was Reliance Bank, White Plains, March 19, 2004.

What's going on in Georgia?

State Bank and Trust Company, Pinehurst, Georgia, Assumes All of the Deposits of the Six Bank Subsidiaries of Security Bank Corporation, Macon, Georgia

FOR IMMEDIATE RELEASE

July 24, 2009

Media Contact:

David Barr

Office Phone: (202) 898-6992

Cell Phone: (703) 622-4790

Email: dbarr@fdic.gov

The six bank subsidiaries of Security Bank Corporation, Macon, Georgia, were closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with State Bank and Trust Company, Pinehurst, Georgia, to assume all of the deposits of the six bank subsidiaries of Security Bank Corporation.

The six banks involved in today's transaction are: Security Bank of Bibb County, Macon, GA, with $1.2 billion in total assets and $1 billion in deposits; Security Bank of Houston County, Perry, GA, with $383 million in assets and $320 million in deposits; Security Bank of Jones County, Gray, GA, with $453 million in assets and $387 million in deposits; Security Bank of Gwinnett County, Suwanee, GA, with $322 million in assets and $292 million in deposits; Security Bank of North Metro, Woodstock, GA, with $224 million in assets and $212 million in deposits; and Security Bank of North Fulton, Alpharetta, GA, with $209 million in assets and $191 million in deposits.

The six banks had a total of 20 branches, which will reopen during normal business hours beginning tomorrow as branches of State Bank and Trust Company. Depositors of the six banks will automatically become depositors of State Bank and Trust Company. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship to retain their deposit insurance coverage. Customers should continue to use their existing branches until State Bank and Trust Company can fully integrate the deposit records of the six failed banks.

Over the weekend, depositors of the six banks can access their money by writing checks or using ATM or debit cards. Checks drawn on the banks will continue to be processed. Loan customers should continue to make their payments as usual.

As of March 31, 2009, the six banks had total assets of $2.8 billion and total deposits of approximately $2.4 billion. In addition to assuming all of the deposits of the failed bank, State Bank and Trust Company will acquire $2.4 billion in assets. The FDIC will retain the remaining assets for later disposition.

The FDIC and State Bank and Trust Company entered into a loss-share transaction on approximately $1.7 billion of the six banks' assets. State Bank and Trust Company will share in the losses on the asset pools covered under the loss-share agreement. The loss-sharing arrangement is projected to maximize returns on the assets covered by keeping them in the private sector. The agreement also is expected to minimize disruptions for loan customers.

Customers who have questions about today's transaction can contact the FDIC as follows:

Failed Bank FDIC Toll-Free Phone Number FDIC Website

Security Bank of Bibb County 1-800-822-0412 http://www.fdic.gov/bank/individual/failed/sb-bibb.html

Security Bank of Houston County 1-800-822-7182 http://www.fdic.gov/bank/individual/failed/sb-houston.html

Security Bank of Jones County 1-800-822-9247 http://www.fdic.gov/bank/individual/failed/sb-jones.html

Security Bank of Gwinnett County 1-800-822-1918 http://www.fdic.gov/bank/individual/failed/sb-gwinnett.html

Security Bank of North Metro 1-800-823-4939 http://www.fdic.gov/bank/individual/failed/sb-metro.html

Security Bank of North Fulton 1-800-823-3215 http://www.fdic.gov/bank/individual/failed/sb-fulton.html

The phone numbers will be operational this evening until 9:00 p.m., Eastern Daylight Time (EDT); on Saturday from 9:00 a.m. to 6:00 p.m., EDT; on Sunday from noon to 6:00 p.m., EDT; and thereafter from 8:00 a.m. to 8:00 p.m., EDT.

To assume all of the deposits and purchase assets from the FDIC as receiver, State Bank and Trust Company received a $300 million capital infusion from a group of 26 investors, led by Joseph Evans.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $807 million. State Bank and Trust Company's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. The failure of the six banks brings the nation's total number this year to 64, and the total for Georgia to 16. The last FDIC-insured institution to be closed in the state was First Piedmont Bank, Winder, on July 17, 2009.

Sunday, July 19, 2009

This Week In Holy Crimes

This Week In Holy Crimes

Over the last seven days...

Florida: Pastor Samuel Darin Taylor charged with defrauding his church of over $250K.

New York: Father James J. McDevitt charged with the sexual abuse of six boys.

Russia: U.S.-based Pastor Hio Sun Pak jailed for 18 months for bribing immigration officials to overlook illegal Chinese labor used to build his church.

Florida: Pastor Donnell Dewitt Williams charged with money laundering after probe reveals $400K in loans processed in the namea of his congregants.

Tennessee: Pastor John Franklin McCarroll charged with indecent exposure at public park. Bonus: Glory hole involved. Extra bonus: McCarroll frequently preached against gay marriage. Extra hilarious bonus: The motto of McCarroll's ministry is "Come as you are, but don't leave like you came."

Texas: Living Praise Christian Academy Prinicpal Darrell Dean Dunn charged with child molestation.

South Carolina: Pastor Leon Dizzley convicted of money laundering for selling nine luxury cars to drug dealers.

New York: Wife of Pastor Mike Bowers charged with 14 felony counts of defrauding a United Nations fund intended to help women in Iraq.

Maryland: Father Aaron Joseph Cote found guilty of child molestation.

Pennsylvania: Christian songwriter and schoolteacher Heather Lynn Zoe charged with having sex with minors. Bonus: Songs on Zoe's debut CD include Face Down and Over And Over.

New York: "Prosperity gospel" motivational speaker Jeffrey Locker found strangled in Harlem. Police suspect the accomplices of the prostitute that Locker had been patronizing.

This week's winners:

India: Father Thomas Kottoor, Father Jose Puthrukayil, and Sister Mary Sephy charged with murdering Sister Mary Abhaya after she walked in them having a threeway. Police say the Holy Trinity beat Sister Abhaya with an axe handle and threw her into a convent well where she drowned.

Saturday, July 18, 2009

We Are So Screwed

We Are So Screwed

Earlier this week, Bondad, Daily Kos's resident economic analyst suggested that there is a Black Swan myth. That's to say that the economy is starting to get better, and that there aren't any potentially catastrophic combinations of economic events on the horizon.

The idea of the Black Swan isn't that events are entirely unforseeable, only that they do not agree with what we think to be true of the world. Because much of what we assume to be economic "truth" occurs operates at a high level of abstraction, linkages that are invisible when we look down on high are missed. And these linkages, like a web, create the possibility for a small event to cascade into something far larger, and more harmful. It often is not any one thing, but the combination of many that creates true crisis. I will get to this, but first let's not fool ourselves into thinking that it's morning in America just yet.

Background

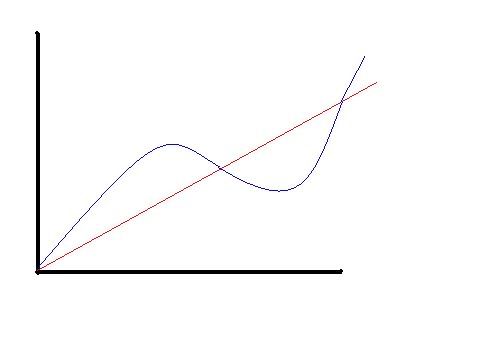

First, the claim that things are starting to improve on the employment front is far more complex than hunky dory picture painted by putting up this graph:

The good news is that last week seasonally adjusted initial claims for unemployment were dropping:

In the week ending July 11, the advance figure for seasonally adjusted initial claims was 522,000, a decrease of 47,000 from the previous week's revised figure of 569,000. The 4-week moving average was 584,500, a decrease of 22,500 from the previous week's revised average of 607,000.

These are the numbers used to produce the graph above. What's not mentioned is that this set of numbers is produced through the manipulation of the actual numbers to conform to a statistical model that attempts to remove seasonal variance to make numbers comparable across seasons. Strip that statistical model away and the numbers tell a far different story.

The advance number of actual initial claims under state programs, unadjusted, totaled 667,534 in the week ending July 11, an increase of 86,389 from the previous week. There were 483,981 initial claims in the comparable week in 2008.

Say again what. The numbers fell, but they actually rose? So which one is right. The hard answer is that they both are supposed to be, but they clearly aren't. Why?

Because the expectations ingrained in the model are wrong. It's a baby black swan. Or more to the point it's a lot of people with a lot of education being incredibly ignorant. What am I talking about?

The seasonal adjusting model operates from the known past, and assumes that there will be summer layoffs for retooling in the auto industry at this time of year. This means that it deflates the actual number of adjusted claims to match what "should" be happening at this time of year. That didn't happen this year. The auto layoffs came early because GM and Chrysler shut down while they went through bankruptcy proceedings. Now that GM is out of court, they've called the guys and gals back in the last week. This has really fucked with the models used to create seasonally adjusted numbers.

The number of Americans filing claims for unemployment benefits fell last week to the lowest level since January, depressed by shifts in the timing of auto plant shutdowns.

Initial jobless claims dropped by 47,000 to 522,000, lower than forecast, in the week ended July 11, from a revised 569,000 the prior week, the Labor Department said today in Washington. The number of people collecting unemployment insurance plunged by a record 642,000, also reflecting seasonal issues surrounding the closures at carmakers.

A Labor analyst said the distortions may play havoc with claims data for another couple of weeks. General Motors Co. and Chrysler Group LLC accelerated shutdowns this year heading into bankruptcy, months before the traditional July closings. Through the gyrations, job losses may subside amid signs the housing and manufacturing slumps are easing.

The distortion started in April and May when large numbers of autoworkers were put on layoff at a time when the model said that plants should be going full bore. It helps to look at the seasonally adjusted and unadjusted numbers from the start of the year to now to get an idea of how this wreaks havoc on the seasonally adjusted reported numbers. As I suggested to New Deal Democrat in Bondad's diary, it's likely that the seasonal adjustment of numbers is obscuring an underlying trend.

I suggested that it would look something like this (blue is seasonally adjusted, red is actual):

If we mock up the seasonally adjusted and real numbers since the start of the year we get this:

Again, there are two different stories, if you want a happy ending you use the blue, seasonally adjusted line. If you want to be more honest about what's happening you use the red line, and you see that unemployment is actually on the rise after having settled down. And worse, this whole measure may not be adequately capturing unemployment. The numbers for initial claims only cover people who are collecting unemployment insurance, but the unemployment rate that we hear about all the time (U-3) includes a much broader group of people

Yesterday the new unemployment statistics came out from the BLS.

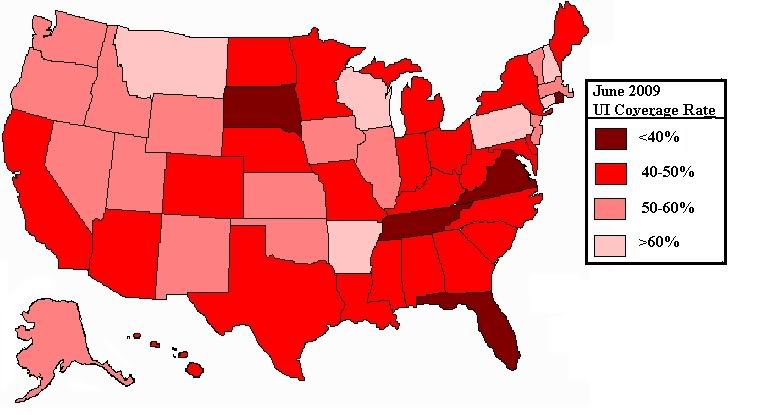

And, the numbers are ugly, 15 states and DC have unemployment rates over 10%, and another 6 are over 9%.

So again, we have competing versions of the truth being presented to us statistically. The seasonally adjusted initial claims suggest that the unemployment situation is improving. The new U-3 ("unemployment) figure suggests that things are still declining. Why the difference?

At least part of the story is that only a portion of the currently unemployed are covered by unemployment insurance. The percentage covered is scandalously low in some areas. For example in Washington, DC only 15% of the unemployed are receiving unemployment benefits. In Pennsylvania, on the other hand, that number is 77%. I've laid this out across the nation on the map below.

Throughout most of the country, the initial claims figure covers less than half of the unemployed. It only gives half the story, literally, and as the recession drags on people are increasingly using up all their unemployment benefits, and still without a job. By the end of the year something like 100,000 people will be in this position if current trends continue.

All the things I've brought up suggest that we should be suspicious of the initial claims number as a measure of unemployment, and that things are still pretty bad out there. It's a problem because these models create expectations, and when those expectations are wrong, the response when the truth comes out is shock and awe. Things go awry, and have an outsized impact, lowering consumer confidence and further hurting the economy. And on top of all this, two very big black swans are getting ready to kiss.

Black Swans on the Horizon

Something like 70% of our economy is based in consumer spending. One of the things that keeps this running smoothly is a process called factoring.

Basically factoring works like this. Let's say that I am a shoe store. I buy shoes from the factory and sell them to customers. When I buy shoes I have a period of time (let's say 60-90 days) to pay shoe factory.

If you are the shoe factory, you don't really want to wait 60-90 days for payment. But you have an option, rather than waiting 60-90 days for me to give you cash, you can sell that obligation to a third party. So you get cash from the factoring company, and I pay that factoring company the money instead of you. You are going to get less than the full amount of money that I owe you, but you are going to get that money now. This means you can buy supplies to buy more shoes now with money in hand instead of having to take out a loan. This is the factoring process.

This is what CIT Group does for thousands of small retailers, including franchisees (like Dunkin' Donuts). CIT Group has a serious problem, they are on the verge of bankruptcy.

What would this mean?

In an environment where there is little credit available to retailers, it would mean that they would be unable to get product into stores. So basically empty shelves, potentially into the holiday season. And, of course empty shelves will mean that many businesses will be forced to close. That means more people out of work in the retail industry.

It doesn't end there. The problem is that if companies have to go back to waiting 60-90 days for payment, they have to cut production. And that means that the people who make shoes, and the like, are out of work also.

In the apparel , something like 60% of the industry depends on CIT for factoring. That could lead to huge disruptions if they go bankrupt.

CIT going bankrupt could mean that thousands of retail shops, distributors, and apparel factories could go out of business. It's the same story in many other sectors. This alone could cause a great loss of jobs.

But, it's worse than that. Any sort of retail collapse is going to mean that lots of commercial real estate suddenly becomes vacant.

This comes at a time when the commercial real estate market is extremely shaky.

The $3.5 trillion commercial real estate market is a ticking “time bomb” that may lead to a second wave of losses at large U.S. banks, congressional Joint Economic Committee Chairwoman Carolyn Maloney said.....

There were 5,315 commercial properties in default, foreclosure or bankruptcy at the end of June, more than twice the number at the end of last year, with hotels and retail among the most “problematic,’ Real Capital Analytics Inc. said in a report yesterday. Losses on commercial mortgage-backed securities, or CMBS, will total 9 percent to 12 percent of the market, or as much as $90 billion, said Richard Parkus, a research analyst for Deutsche Bank Securities in New York.

And it's worse than that. Remember that through the magic of Credit Default Swaps (CDS), a $90 Billion nominal loss may lead to an amount 10-20 times that being lost in derivatives markets. Which means the exposure for banks could be huge. And it's not just any banks that are in danger here:

A disproportionately high number of small and medium-sized banks have “sizable exposure” to commercial real estate loans, and delinquency rates at around 7 percent in the first quarter are almost double from a year ago, he said.

In other words if there has to be a rescue, we are likely going to see large banks based in New York swallowing up local and regional banks across the country at fire sale prices. And the concentration of financial power in this country will continue apace.

It's not the CIT situation or commercial real estate alone that can do the real damage, but together the situation is made worse.

A CIT bankruptcy could lead to spiraling retail closures, creating large numbers of distressed commercial properties. Banks would have to hold on even tighter to cash to stay solvent in this environment, meaning less money lent. Less money lent means retail and production companies have less ability to ride out the recession through deficit financing. Which means even more commercial real estate goes vacant. And so on, and so on, until a horrible amount of damage has been done.

This has the smell of a real Black Swan, and it comes at a time when people (falsely) believe that things are finally improving.

Friday, July 17, 2009

LATE BREAKING NEWS!!

Goldman Sachs in Talks to Acquire Treasury Department

Sister Entities to Share Employees, Money

In what some on Wall Street are calling the biggest blockbuster deal in the history of the financial sector, Goldman Sachs confirmed today that it was in talks to acquire the U.S. Department of the Treasury.

According to Goldman spokesperson Jonathan Hestron, the merger between Goldman and the Treasury Department is "a good fit" because "they're in the business of printing money and so are we."

The Goldman spokesman said that the merger would create efficiencies for both entities: "We already have so many employees and so much money flowing back and forth, this would just streamline things."

Mr. Hestron said the only challenge facing Goldman in completing the merger "is trying to figure out which parts of the Treasury Dept. we don't already own."

Goldman recently celebrated record earnings by roasting a suckling pig over a bonfire of hundred-dollar bills.

Elsewhere, conspiracy theorists celebrated the 40th anniversary of NASA faking the moon landing.

And in South Carolina, Gov. Mark Sanford gave his wife a new diamond ring, while his wife gave him an electronic ankle bracelet

Bank Failures #54, 55, 56, 57

Bank Failure #54: First Piedmont Bank, Winder, Georgia

Bank Failure #55: BankFirst, Sioux Falls, South Dakota

Bank Failures #56 & #57: Temecula Valley Bank, Temecula, CA and Vineyard Bank, Rancho Cucamonga, CA

I love them "green shoots". Meanwhile, all the big guys seem to be making record profits --- or, at least they are SHOWING record profits.

This from FDIC:

Bank Failures in Brief

2009

The list of Bank Failures in Brief is updated through July 17, 2009. Please address questions on this subject to the Customer Service Hotline (telephone: 888-206-4662).

July

Temecula Valley Bank, Temecula, California, with approximately $1.5 billion in assets, was closed. First-Citizens Bank & Trust Company, Raleigh, North Carolina, has agreed to assume all deposits, excluding certain brokered deposits (approximately $1.3 billion). (PR-126-2009)

Vineyard Bank, N.A., Rancho Cucamonga, California, with approximately $1.9 billion in assets, was closed. California Bank & Trust, San Diego, California, has agreed to assume all deposits, excluding certain brokered deposits (approximately $1.6 billion). (PR-125-2009)

BankFirst, Sioux Falls, South Dakota, with approximately $275 million in assets, was closed. Alerus Financial, National Association, Grand Forks, North Dakota, has agreed to assume all deposits (approximately $254 million). (PR-124-2009)

First Piedmont Bank, Winder, Georgia, with approximately $115 million in assets, was closed. First American Bank and Trust Company, Athens, Georgia, has agreed to assume all deposits (approximately $109 million). (PR-123-2009)

Wednesday, July 15, 2009

Computer Problems

Fortunately my sweetie was once a tech. She bought a new case, with a new power supply (for less than a skimpy Sony power supply would have cost) moved everything, figured out how the proprietory connectors worked, and hooked me up.

I now have an old computer in a new case, with much more room to work, bigger power supply, new fans -- and will be adding more memory and a new drive (when we can find a good sale).

With a little luck, I'm good for another 3 - 4 years (fingers crossed).

Anyway, that's why there's been nary a peep from me.

By the way, last Friday, #53 bit the dust (bank, that is).

When will the big ones start to go?

Wednesday, July 8, 2009

Distressed Commercial Property in U.S. Doubles to 108 BILLION

By David M. Levitt

July 8 (Bloomberg) -- Commercial properties in the U.S. valued at more than $108 billion are now in default, foreclosure or bankruptcy, almost double than at the start of the year, Real Capital Analytics Inc. said.

There were 5,315 buildings in financial distress at the end of June, the New York-based real estate research firm said in a report issued today. That’s more than twice the number of troubled properties at the end of 2008.

Hotels and retail properties are among the most “problematic” assets following bankruptcy filings by mall owner General Growth Properties Inc. and Extended Stay America Inc., according to the report. The scarcity of credit is causing property defaults in all regions and among every investor type, Real Capital said.

“Perhaps more alarming than the rapid growth in the distress totals is the very modest rate at which troubled situations are being resolved,” the report said.

About $4.1 billion of commercial properties have emerged from distress, according to Real Capital.

“In far more situations, modifications and short-term extensions are being granted, but these can hardly be considered resolved, only delayed,” the study said.

The June figures issued today are preliminary.

To contact the reporter on this story: David M. Levitt in New York at dlevitt@bloomberg.net.

Monday, July 6, 2009

"Only A Matter of Time"

This from "When Giants Fall" -- it doesn't matter if you agree or not -- it's still an interesting read.

Only a Matter of Time

When I wrote Financial Armageddon and, later, When Giants Fall, my sense was that the Great Unraveling would entail a series of overlapping crises: first financial, then economic, social, and finally geopolitical.

So far, in my view, we have moved some way through the initial phase (though there are still a few more disasters still to come), and the next stage, the economic crisis, has probably shifted into second gear.

In regard to the third or "social" phase, however, we've yet to see any real traction. However, I believe it is only a matter of time -- and, apparently, so does The Telegraph's Ambrose Evans-Pritchard, as he notes below in "The Unemployment Timebomb Is Quietly Ticking" -- before things begin to flare up on that front.

One dog has yet to bark in this long winding crisis. Beyond riots in Athens and a Baltic bust-up, we have not seen evidence of bitter political protest as the slump eats away at the legitimacy of governing elites in North America, Europe, and Japan. It may just be a matter of time.

One of my odd experiences covering the US in the early 1990s was visiting militia groups that sprang up in Texas, Idaho, and Ohio in the aftermath of recession. These were mostly blue-collar workers, – early victims of global "labour arbitrage" – angry enough with Washington to spend weekends in fatigues with M16 rifles. Most backed protest candidate Ross Perot, who won 19pc of the presidential vote in 1992 with talk of shutting trade with Mexico.

The inchoate protest dissipated once recovery fed through to jobs, although one fringe group blew up the Oklahoma City Federal Building in 1995. Unfortunately, there will be no such jobs this time. Capacity use has fallen to record-low levels (68pc in the US, 71 in the eurozone). A deep purge of labour is yet to come.

The shocker last week was not just that the US lost 467,000 jobs in May, but also that time worked fell 6.9pc from a year earlier, dropping to 33 hours a week. "At no time in the 1990 or 2001 recessions did we ever come close to seeing such a detonating jobs figure," said David Rosenberg from Glukin Sheff. "We have lost a record nine million full-time jobs this cycle."

Earnings have fallen at a 1.6pc annual rate over the last three months. Wage deflation is setting in – like Japan. Interestingly, The International Labour Organisation is worried enough to push for a global pact, fearing countries may set off a ruinous spiral by chipping away at wages try to gain beggar-thy-neighbour advantage.

Some of the US pay cuts are disguised. Over 238,000 state workers in California have been working two days less a month without pay since February. Variants of this are happening in 22 states.

The Centre for Labour Market Studies (CLMS) in Boston says US unemployment is now 18.2pc, counting the old-fashioned way. The reason why this does not "feel" like the 1930s is that we tend to compress the chronology of the Depression. It takes time for people to deplete their savings and sink into destitution. Perhaps our greater cushion of wealth today will prevent another Grapes of Wrath, but 20m US homeowners are already in negative equity (zillow.com data). Evictions are running at a terrifying pace.

Some 342,000 homes were foreclosed in April, pushing a small army of children into a network of charity shelters. This compares to 273,000 homes lost in the entire year of 1932. Sheriffs in Michigan and Illinois are quietly refusing to toss families on to the streets, like the non-compliance of Catholic police in the Slump.

Europe is a year or so behind, but catching up fast. Unemployment has reached 18.7pc in Spain (37pc for youths), and 16.3pc in Latvia. Germany has delayed the cliff-edge effect by paying companies to keep furloughed workers through "Kurzarbeit". Germany's "Wise Men" fear that the jobless rate will jump from 3.7m to 5.1m by next year. The OECD expects unemployment to reach 57m in the rich countries by the end of next year.

This is the deadly lag effect. What is so disturbing is that governments have not even begun the spending squeeze that must come to stop their countries spiralling into a debt compound trap.

French president Nicolas Sarkozy, with a good nose for popular moods, says: "We must overhaul everything. We cannot have a system of rentiers and social dumping under globalisation. Either we have justice or we will have violence. It is a chimera to think that this crisis is just a footnote and that we can carry on as before."

The message has not reached Wall Street or the City. If bankers know what is good for them, they will take a teacher's salary for a few years until the storm passes. If they proceed with the bonuses now on the table, even as taxpayers pay for the errors of their caste, they must expect a ferocious backlash.

We are fortunate that the US has a new president enjoying a great reservoir of sympathy, and a clean-broom Congress. Other nations must limp on with carcass governments: Germany's paralysed Left-Right coalition, the burned-out relics of Japan's LDP, and Labour's death march in Britain. Some are taking precautions: Silvio Berlusconi is trying to emasculate Italy's parliament (with little protest) while the Kremlin has activated "anti-crisis" units to nip protest in the bud.

We are moving into Phase II of the Great Unwinding. It may be time to put away our texts of Keynes, Friedman, and Fisher, so useful for Phase 1, and start studying what happened to society when global unemployment went haywire in 1932Saturday, July 4, 2009

More on Bank Failures

By Ari Levy and Flynn McRoberts

July 2 (Bloomberg) -- Six banks in Illinois and one in Texas were seized by regulators as the deepening financial crisis pushed the toll of failed U.S. lenders this year to 52, the most since 1992.

Twelve banks have failed this year in Illinois, the most of any state. The seven lenders seized today, with total assets of $1.49 billion and deposits of $1.34 billion, were closed by state or federal regulators and the Federal Deposit Insurance Corp. was named receiver, according to statements from the FDIC. Buyers were named for each of the closed institutions.

The Illinois banks are affiliates of Peotone Bank & Trust Co., in Peotone, Illinois, about 45 miles (72 kilometers) south of Chicago. The failures resulted primarily because of soured loans and losses on investments in collateralized debt obligations, the FDIC said. Illinois, with an unemployment rate above the national average, was one of seven states to begin the fiscal year yesterday without a spending plan.

“The six failed Illinois banks are all controlled by one family and followed a similar business model that created concentrated exposure in each institution,” the FDIC said. CDOs, which packaged bonds and loans into notes of varying risk and yield, lost money as real estate defaults soared.

Regulators this year have closed the most banks since the savings-and-loan crisis of the 1990s as lenders struggle with mounting losses on mortgages and commercial loans. The total for 2009 is more than double the 25 banks shuttered in 2008 and surpasses the 50 that were closed in 1993. The prior year there were 181 failures or government-assisted transactions.

FDIC Fund

The FDIC estimates today’s seizures will cost its insurance fund $314.3 million. The regulator imposed an emergency fee in May to raise $5.6 billion to rebuild the fund, which has deteriorated in the past 18 months. More assessments are possible, the FDIC said.

Illinois Governor Pat Quinn, a Democrat, refused to sign a budget because lawmakers failed to approve raising the income tax. In his original $53 billion budget proposal in March, the governor sought personal and corporate tax increases to help eliminate an $11.6 billion deficit and maintain state services.

Chicago is 280 miles from Detroit, home to General Motors Corp. and Chrysler LLC, which were forced into bankruptcy. Lear Corp., the Southfield, Michigan-based maker of automotive seats, announced plans today to enter bankruptcy. The unemployment rate in Illinois was 10.1 percent in May, compared with 9.4 percent nationally.

‘A Mess’

“This is a mess,” said Jack Ablin, who oversees $60 billion as chief investment officer at Harris Private Bank in Chicago. “We’re a manufacturing state and in the Midwest, so we’re influenced by the autos.”

In addition to CDOs, the failed banks were plagued by losses on commercial real estate loans. Founders Bank of Worth, the biggest of the Illinois banks seized today, had $374 million in construction and commercial real estate loans as of March, accounting for 63 percent of the bank’s net loans and leases, according to a regulatory report.

Millennium State Bank of Texas, the Dallas-based bank taken over by a state regulator today, had $67.5 million in such loans, or 81 percent of its total loans.

“The common denominator for most of the bank failures so far has been troubled construction loans,” said Matthew Anderson of Foresight Analytics, an Oakland, California-based real estate research firm. “There’s no easy way out with defaulted construction loans in today’s environment.”

The Illinois banks have a combined 29 branches, which will all open under new ownership by July 6, the FDIC said. Millennium’s lone office will open that day as a unit of Irvine- based State Bank of Texas.

The following table lists the banks that were seized today. Asset and deposit figures are in millions of U.S. dollars.

Failed Bank Buyer Assets Deposits

Founders Bank PrivateBank & Trust 962.5 848.9 Worth, IL Chicago

First National First Financial 166 147 Danville, IL Terre Haute, IN

Millennium State State Bank of Texas 118 115 Dallas Irving

Rock River Bank Harvard State Bank 77 75.8 Oregon, IL Harvard, IL

Elizabeth State Bank Galena State Bank 55.5 50.4 Elizabeth, IL Galena, IL

John Warner State Bank of Lincoln 70 64 Clinton, IL Lincoln, IL

First State Bank First National 36 34 Winchester, IL Beardstown, IL

To contact the reporters on this story: Ari Levy in San Francisco at alevy5@bloomberg.net; Flynn McRoberts at fmcroberts1@bloomberg.net.

Friday, July 3, 2009

52 so far this year

Anyway, I'm back. more stuff tomorrow.

7 More Today

Bank Failures in Brief

2009

The list of Bank Failures in Brief is updated through July 2, 2009. Please address questions on this subject to the Customer Service Hotline (telephone: 888-206-4662).

July

Founders Bank, Worth, Illinois, with approximately $962.5 million in assets, was closed. The PrivateBank and Trust Company, Chicago, Illinois, has agreed to assume all deposits (approximately $848.9 million). (PR-119-2009)

Millennium State Bank of Texas, Dallas, Texas, with approximately $118 million in assets, was closed. State Bank of Texas, Irving, Texas, has agreed to assume all deposits (approximately $115 million). (PR-118-2009)

The First National Bank of Danville, Danville, Illinois, with approximately $166 million in assets, was closed. First Financial Bank, N.A., Terre Haute, Indiana, has agreed to assume all deposits (approximately $147 million). (PR-117-2009)

The Elizabeth State Bank, Elizabeth, Illinois, with approximately $55.5 million in assets, was closed. Galena State Bank and Trust Company, Galena, Illinois, has agreed to assume all deposits (approximately $50.4 million). (PR-116-2009)

Rock River Bank, Oregon, Illinois, with approximately $77 million in assets, was closed. The Harvard State Bank, Harvard, Illinois, has agreed to assume all deposits (approximately $75.8 million). (PR-115-2009)

The First State Bank of Winchester, Winchester, Illinois, with approximately $36 million in assets, was closed. The First National Bank of Beardstown, Beardstown, Illinois, has agreed to assume all deposits (approximately $34 million). (PR-114-2009)

The John Warner Bank, Clinton, Illinois, with approximately $70 million in assets, was closed. State Bank of Lincoln, Lincoln, Illinois, has agreed to assume all deposits (approximately $64 million). (PR-113-2009)