| Press Releases Home Federal Bank, Nampa, Idaho, Assumes All of the Deposits of LibertyBank, Eugene, Oregon

LibertyBank, Eugene, Oregon, was closed today by the Oregon Division of Finance and Corporate Securities, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Home Federal Bank, Nampa, Idaho, to assume all of the deposits of LibertyBank. The 15 branches of LibertyBank will reopen on Monday as branches of Home Federal Bank. Depositors of LibertyBank will automatically become depositors of Home Federal Bank. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship in order to retain their deposit insurance coverage. Customers of LibertyBank should continue to use their existing branch until they receive notice from Home Federal Bank that it has completed systems changes to allow other Home Federal Bank branches to process their accounts as well. This evening and over the weekend, depositors of LibertyBank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual. As of March 31, 2010, LibertyBank had approximately $768.2 million in total assets and $718.5 million in total deposits. Home Federal Bank paid the FDIC a premium of 1.0 percent for the deposits of LibertyBank. In addition to assuming all of the deposits of the failed bank, Home Federal Bank agreed to purchase approximately $419.7 million of the failed bank's assets. The FDIC and Home Federal Bank entered into a loss-share transaction on $300.0 million of LibertyBank's assets. Home Federal Bank will share in the losses on the asset pools covered under the loss-share agreement. The loss-share transaction is projected to maximize returns on the assets covered by keeping them in the private sector. The transaction also is expected to minimize disruptions for loan customers. For more information on loss share, please visit: http://www.fdic.gov/bank/individual/failed/lossshare/index.html. Customers who have questions about today's transaction can call the FDIC toll-free at 1-800-523-8159. The phone number will be operational this evening until 9:00 p.m., Pacific Daylight Time (PDT); on Saturday from 9:00 a.m. to 6:00 p.m., PDT; on Sunday from noon to 6:00 p.m., PDT; and thereafter from 8:00 a.m. to 8:00 p.m., PDT. Interested parties also can visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/libertyor.html. The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $115.3 million. Compared to other alternatives, Home Federal Bank's acquisition was the least costly resolution for the FDIC's DIF. LibertyBank is the 108th FDIC-insured institution to fail in the nation this year, and the third in Oregon. The last FDIC-insured institution closed in the state was Home Valley Bank, Cave Junction, on July 23, 2010. # # # | ||||

Friday, July 30, 2010

108

107

Press Releases

Heritage Bank, Olympia, Washington, Assumes All of the Deposits of The Cowlitz Bank, Longview, Washington

| FOR IMMEDIATE RELEASE July 30, 2010 |

The Cowlitz Bank, Longview, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Heritage Bank, Olympia, Washington, to assume all of the deposits of The Cowlitz Bank.

The nine branches of The Cowlitz Bank, including the two branches operating in Oregon, and three branches operating in Washington under the name Bay Bank, a division of The Cowlitz Bank, will reopen on Saturday during normal banking hours as branches of Heritage Bank. Depositors of The Cowlitz Bank will automatically become depositors of Heritage Bank. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship in order to retain their deposit insurance coverage. Customers of The Cowlitz Bank should continue to use their existing branch until they receive notice from Heritage Bank that it has completed systems changes to allow other Heritage Bank branches to process their accounts as well.

This evening and over the weekend, depositors of The Cowlitz Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of March 31, 2010, The Cowlitz Bank had approximately $529.3 million in total assets and $513.9 million in total deposits. Heritage Bank paid the FDIC a premium of 1.0 percent for the deposits of The Cowlitz Bank. In addition to assuming all of the deposits of the failed bank, Heritage Bank agreed to purchase approximately $329.5 million of the failed bank's assets. The FDIC will retain the remaining assets for later disposition.

The FDIC and Heritage Bank entered into a loss-share transaction on $160.9 million of The Cowlitz Bank's assets. Heritage Bank will share in the losses on the asset pools covered under the loss-share agreement. The loss-share transaction is projected to maximize returns on the assets covered by keeping them in the private sector. The transaction also is expected to minimize disruptions for loan customers. For more information on loss share, please visit: http://www.fdic.gov/bank/individual/failed/lossshare/index.html.

Customers who have questions about today's transaction can call the FDIC toll-free at 1-800-528-6215. The phone number will be operational this evening until 9:00 p.m., Pacific Daylight Time (PDT); on Saturday from 9:00 a.m. to 6:00 p.m., PDT; on Sunday from noon to 6:00 p.m., PDT; and thereafter from 8:00 a.m. to 8:00 p.m., PDT. Interested parties also can visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/cowlitz.html.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $68.9 million. Compared to other alternatives, Heritage Bank's acquisition was the least costly resolution for the FDIC's DIF. The Cowlitz Bank is the 107th FDIC-insured institution to fail in the nation this year, and the eighth in Washington. The last FDIC-insured institution closed in the state was Washington First International Bank, Seattle, on June 11, 2010.

105 AND 106

| Press Releases Centennial Bank, Conway, Arkansas, Acquires All of the Deposits of Two Institutions in Florida Bayside Savings Bank, Port Saint Joe and Coastal Community Bank, Panama City Beach

Bayside Savings Bank, Port Saint Joe, Florida and Coastal Community Bank, Panama City Beach, Florida, were closed today by federal and state banking agencies, which then appointed the Federal Deposit Insurance Corporation (FDIC) as receiver for both institutions. To protect depositors, the FDIC entered into purchase and assumption agreements with Centennial Bank, Conway, Arkansas, to assume all the deposits and essentially all the assets of the two failed institutions. Bayside Savings Bank was closed by the Office of Thrift Supervision, and Coastal Community Bank was closed by the Florida Office of Financial Regulation. Collectively, the two failed institutions operated 13 branches, which will reopen as branches of Centennial Bank during normal business hours, including those offices with Saturday hours. Bayside Savings Bank has two branches, and Coastal Community Bank has eleven branches. Depositors of Bayside Savings Bank and Coastal Community Bank will automatically become depositors of Centennial Bank. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship to retain their deposit insurance coverage. Customers of the two failed institutions should continue to use their former branches. Over the weekend, depositors can access their money by writing checks or using ATM or debit cards. As of March 31, 2010, Bayside Savings Bank had total assets of $66.1 million and total deposits of $52.4 million. Coastal Community Bank had total assets of $372.9 million and total deposits of $363.2 million. Centennial Bank did not pay the FDIC a premium for the deposits of the failed banks. In addition to assuming all the deposits from the two Florida institutions, Centennial Bank will purchase virtually all their assets. The FDIC and Centennial Bank entered into loss-share transactions on $48.3 million of Bayside Savings Bank's assets and $302.8 million of Coastal Community Bank's assets. Centennial Bank will share in the losses on the asset pools covered under the loss-share agreement. The loss-share transaction is projected to maximize returns on the assets covered by keeping them in the private sector. The transaction also is expected to minimize disruptions for loan customers. For more information on loss share, please visit: http://www.fdic.gov/bank/individual/failed/lossshare/index.html. Customers who have questions about today's transactions can call the FDIC toll free: for Bayside Savings Bank customers, 1-800-405-6318; and for Coastal Community Bank customers, 1-800-523-0640. The phone number for Bayside Savings will be operational this evening until 9:00 p.m., Eastern Daylight Time (EDT); on Saturday from 8:00 a.m. to 6:00 p.m., EDT; on Sunday from noon until 6:00 p.m., EDT; and thereafter from 8:00 a.m. to 8:00 p.m., EDT; and during the same hours, Central Daylight Time, for Coastal Community Bank customers. Interested parties can also visit the FDIC's Web sites: for Bayside Savings Bank, http://www.fdic.gov/bank/individual/failed/bayside.html; and for Coastal Community Bank, http://www.fdic.gov/bank/individual/failed/coastal.html. The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $16.2 million for Bayside Savings Bank and $94.5 million for Coastal Community Bank. Compared to other alternatives, Centennial Bank's acquisition was the least costly resolution for the FDIC's DIF. These two closings bring total closures for the year to 106 banks in the nation, and the 19th and 20th in Florida. Prior to these failures, the last bank closed in Florida was Sterling Bank, Lantana, on July 23, 2010. | ||||

#104

| Press Releases State Bank and Trust Company, Macon, Georgia, Assumes All of the Deposits of NorthWest Bank and Trust, Acworth, Georgia

NorthWest Bank and Trust, Acworth, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with State Bank and Trust Company, Macon, Georgia, to assume all of the deposits of NorthWest Bank and Trust. The two branches of NorthWest Bank and Trust will reopen on Saturday as branches of State Bank and Trust Company. Depositors of NorthWest Bank and Trust will automatically become depositors of State Bank and Trust Company. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship in order to retain their deposit insurance coverage. Customers of NorthWest Bank and Trust should continue to use their existing branch until they receive notice from State Bank and Trust Company that it has completed systems changes to allow other State Bank and Trust Company branches to process their accounts as well. This evening and over the weekend, depositors of NorthWest Bank and Trust can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual. As of March 31, 2010, NorthWest Bank and Trust had approximately $167.7 million in total assets and $159.4 million in total deposits. State Bank and Trust Company did not pay the FDIC a premium for the deposits of NorthWest Bank and Trust. In addition to assuming all of the deposits of the failed bank, State Bank and Trust Company agreed to purchase essentially all of the failed bank's assets. The FDIC and State Bank and Trust Company entered into a loss-share transaction on $107.6 million of NorthWest Bank and Trust's assets. State Bank and Trust Company will share in the losses on the asset pools covered under the loss-share agreement. The loss-share transaction is projected to maximize returns on the assets covered by keeping them in the private sector. The transaction also is expected to minimize disruptions for loan customers. For more information on loss share, please visit: http://www.fdic.gov/bank/individual/failed/lossshare/index.html. Customers who have questions about today's transaction can call the FDIC toll-free at 1-800-591-2916. The phone number will be operational this evening until 9:00 p.m., Eastern Daylight Time (EDT); on Saturday from 9:00 a.m. to 6:00 p.m., EDT; on Sunday from noon to 6:00 p.m., EDT; and thereafter from 8:00 a.m. to 8:00 p.m., EDT. Interested parties also can visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/NorthWestga.html. The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $39.8 million. Compared to other alternatives, State Bank and Trust Company's acquisition was the least costly resolution for the FDIC's DIF. NorthWest Bank and Trust is the 104th FDIC-insured institution to fail in the nation this year, and the 11th in Georgia. The last FDIC-insured institution closed in the state was Crescent Bank and Trust Company, Jasper, on July 23, 2010. | ||||

Thursday, July 29, 2010

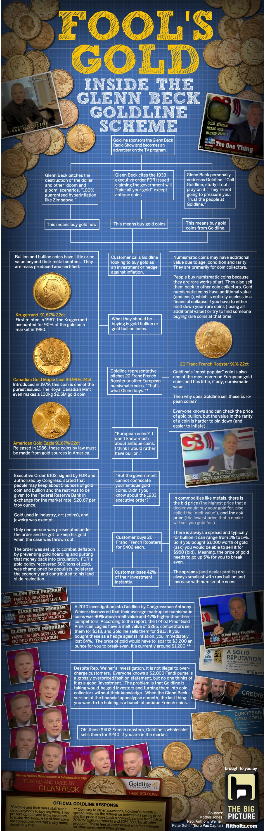

"Fool's Gold"

Basically, if you want to buy fold -- buy bullion.

Infographic by The Big Picture

Wednesday, July 28, 2010

Please think about this

"BP was charged with criminal violations of federal environmental laws and has been subject to lawsuits from the victim's families. The Occupational Safety and Health Administration slapped BP with a then-record fine for hundreds of safety violations, and subsequently imposed an even larger fine after claiming that BP had failed to implement safety improvements following the disaster." (Wikipedia).

Of the 761 major safety and environmental violations over the last 4 or so years, BP has been guilty of 760.

NOW, when I see all the hand wringing and finger pointing by our various and sundry "leaders", I wonder where they have been all these years. BP has been guilty of serious breaches of all sorts of rules -- that OTHER oil companies manage to follow (more or less) -- for YEARS.

Where were all the Congressional "watchdogs" then? Where were the "protectors of the public good", the current "outraged leaders"?

This sort of crap has been going on for YEARS. There are various and sundry spills (oops!) almost DAILY. Unless you are personally affected -- you never hear about it.

In Great Britain BP portrays us as sniveling whiners. They cast themselves as "model corporate citizens" -- you know how weak those Americans are, don't you?

Unless you are there, unless you experience it, you do not have a clue.

Meanwhile, BP has a "full court press" from their PR folks. Our government folks go, "tsk-tsk", and point fingers.

Slowly the seas (ALL of them) will die, our government "watchdogs" will do nothing, the various corporations will continue to pay off judges and various legislators ---- punctuated by flurries of activity ("see how good I am") when the oil, or the shit hits the fan.

As I've said -- I'm beyond cynicism -- a cynic still has some hope.

Tuesday, July 27, 2010

my current state

Right now I am beyond cynicism, beyond anger, beyond ..............damn near anything!

The news has begun to read like dispatches from some strange sci-fi novel. We have a Vietnam "time warp", with the release of "secret" documents about our current war. It seems no one has thought to say -- "wow! the military must be really depressed, pissed off, angry, about our current 'progress' in our multiple wars, to leak all this crap."

At the same time, Obama is so damn obedient to his corporate masters that every "stunning, earth shattering, legislative achievement" is greeted with a yawn.

It seems there is either not enough there, or his (lack of) brain trust does not know how to build enthusiasm.

The economy is ready for another tumble, the Republicans oppose EVERYTHING -- and, it looks like people are stupid enough to vote them back into power.

Well, I guess another Republican administration will REALLY "heighten the contradiction".

Bah, humbug, I'm tired of total cynics leading the terminally stupid -- on all sides.

Sunday, July 25, 2010

The political genius of supply-side economics

The political genius of supply-side economics

July 25, 2010 4:18pm | Share

The future of fiscal policy was intensely debated in the FT last week. In this Exchange, I want to examine what is going on in the US and, in particular, what is going on inside the Republican party. This matters for the US and, because the US remains the world’s most important economy, it also matters greatly for the world.

My reading of contemporary Republican thinking is that there is no chance of any attempt to arrest adverse long-term fiscal trends should they return to power. Moreover, since the Republicans have no interest in doing anything sensible, the Democrats will gain nothing from trying to do much either. That is the lesson Democrats have to draw from the Clinton era’s successful frugality, which merely gave George W. Bush the opportunity to make massive (irresponsible and unsustainable) tax cuts. In practice, then, nothing will be done.

Indeed, nothing may be done even if a genuine fiscal crisis were to emerge. According to my friend, Bruce Bartlett, a highly informed, if jaundiced, observer, some “conservatives” (in truth, extreme radicals) think a federal default would be an effective way to bring public spending they detest under control. It should be noted, in passing, that a federal default would surely create the biggest financial crisis in world economic history.

To understand modern Republican thinking on fiscal policy, we need to go back to perhaps the most politically brilliant (albeit economically unconvincing) idea in the history of fiscal policy: “supply-side economics”. Supply-side economics liberated conservatives from any need to insist on fiscal rectitude and balanced budgets. Supply-side economics said that one could cut taxes and balance budgets, because incentive effects would generate new activity and so higher revenue.

The political genius of this idea is evident. Supply-side economics transformed Republicans from a minority party into a majority party. It allowed them to promise lower taxes, lower deficits and, in effect, unchanged spending. Why should people not like this combination? Who does not like a free lunch?

How did supply-side economics bring these benefits? First, it allowed conservatives to ignore deficits. They could argue that, whatever the impact of the tax cuts in the short run, they would bring the budget back into balance, in the longer run. Second, the theory gave an economic justification – the argument from incentives - for lowering taxes on politically important supporters. Finally, if deficits did not, in fact, disappear, conservatives could fall back on the “starve the beast” theory: deficits would create a fiscal crisis that would force the government to cut spending and even destroy the hated welfare state.

In this way, the Republicans were transformed from a balanced-budget party to a tax-cutting party. This innovative stance proved highly politically effective, consistently putting the Democrats at a political disadvantage. It also made the Republicans de facto Keynesians in a de facto Keynesian nation. Whatever the rhetoric, I have long considered the US the advanced world’s most Keynesian nation – the one in which government (including the Federal Reserve) is most expected to generate healthy demand at all times, largely because jobs are, in the US, the only safety net for those of working age.

True, the theory that cuts would pay for themselves has proved altogether wrong. That this might well be the case was evident: cutting tax rates from, say, 30 per cent to zero would unambiguously reduce revenue to zero. This is not to argue there were no incentive effects. But they were not large enough to offset the fiscal impact of the cuts (see, on this, Wikipedia and a nice chart from Paul Krugman).

Indeed, Greg Mankiw, no less, chairman of the Council of Economic Advisers under George W. Bush, has responded to the view that broad-based tax cuts would pay for themselves, as follows: “I did not find such a claim credible, based on the available evidence. I never have, and I still don’t.” Indeed, he has referred to those who believe this as “charlatans and cranks”. Those are his words, not mine, though I agree. They apply, in force, to contemporary Republicans, alas,

Since the fiscal theory of supply-side economics did not work, the tax-cutting eras of Ronald Reagan and George H. Bush and again of George W. Bush saw very substantial rises in ratios of federal debt to gross domestic product. Under Reagan and the first Bush, the ratio of public debt to GDP went from 33 per cent to 64 per cent. It fell to 57 per cent under Bill Clinton. It then rose to 69 per cent under the second George Bush. Equally, tax cuts in the era of George W. Bush, wars and the economic crisis account for almost all the dire fiscal outlook for the next ten years (see the Center on Budget and Policy Priorities).

Today’s extremely high deficits are also an inheritance from Bush-era tax-and-spending policies and the financial crisis, also, of course, inherited by the present administration. Thus, according to the International Monetary Fund, the impact of discretionary stimulus on the US fiscal deficit amounts to a cumulative total of 4.7 per cent of GDP in 2009 and 2010, while the cumulative deficit over these years is forecast at 23.5 per cent of GDP. In any case, the stimulus was certainly too small, not too large.

The evidence shows, then, that contemporary conservatives (unlike those of old) simply do not think deficits matter, as former vice-president Richard Cheney is reported to have told former treasury secretary Paul O’Neill. But this is not because the supply-side theory of self-financing tax cuts, on which Reagan era tax cuts were justified, has worked, but despite the fact it has not. The faith has outlived its economic (though not its political) rationale.

So, when Republicans assail the deficits under President Obama, are they to be taken seriously? Yes and no. Yes, they are politically interested in blaming Mr Obama for deficits, since all is viewed fair in love and partisan politics. And yes, they are, indeed, rhetorically opposed to deficits created by extra spending (although that did not prevent them from enacting the unfunded prescription drug benefit, under President Bush). But no, it is not deficits themselves that worry Republicans, but rather how they are caused: deficits caused by tax cuts are fine; but spending increases brought in by Democrats are diabolical, unless on the military.

Indeed, this is precisely what John Kyl (Arizona), a senior Republican senator, has just said:

“[Y]ou should never raise taxes in order to cut taxes. Surely Congress has the authority, and it would be right to — if we decide we want to cut taxes to spur the economy, not to have to raise taxes in order to offset those costs. You do need to offset the cost of increased spending, and that’s what Republicans object to. But you should never have to offset the cost of a deliberate decision to reduce tax rates on Americans”

What conclusions should outsiders draw about the likely future of US fiscal policy?

First, if Republicans win the mid-terms in November, as seems likely, they are surely going to come up with huge tax cut proposals (probably well beyond extending the already unaffordable Bush-era tax cuts).

Second, the White House will probably veto these cuts, making itself even more politically unpopular.

Third, some additional fiscal stimulus is, in fact, what the US needs, in the short term, even though across-the-board tax cuts are an extremely inefficient way of providing it.

Fourth, the Republican proposals would not, alas, be short term, but dangerously long term, in their impact.

Finally, with one party indifferent to deficits, provided they are brought about by tax cuts, and the other party relatively fiscally responsible (well, everything is relative, after all), but opposed to spending cuts on core programmes, US fiscal policy is paralysed. I may think the policies of the UK government dangerously austere, but at least it can act.

This is extraordinarily dangerous. The danger does not arise from the fiscal deficits of today, but the attitudes to fiscal policy, over the long run, of one of the two main parties. Those radical conservatives (a small minority, I hope) who want to destroy the credit of the US federal government may succeed. If so, that would be the end of the US era of global dominance. The destruction of fiscal credibility could be the outcome of the policies of the party that considers itself the most patriotic.

In sum, a great deal of trouble lies ahead, for the US and the world.

Where am I wrong, if at all?

Generation Gap

I'm very surprised this has not had more publicity. Then again, most of our economic writers and bloggers have one or another axe to grind.

As you may know, I tend to favor Krugman. To me he just makes sense.

July 16, 2010, 2:27 pm

Generation Gap

The generation gap is larger than it ever was.

Or so says the University of Michigan consumer sentiment index, out today.

Here are some index levels (1966 sentiment equals 100) from the preliminary July figures, as compared to January, the recent peak in overall sentiment.

Over all: Down 7.9, to 66.5

People over 55 years old: Down 9.6, to 60.6

People 35-54: Down 6, to 69.1

People 18-34: Up 12.2, to 98.

It is normal for the youth to be more optimistic than the older folk, but this is the largest margin on record. The numbers go back to 1961, although for many years the survey was annual rather than monthly.

The younger group now reports better sentiment than at any time since late 2007, before the recession began. The older group sentiment is at the lowest level since March 2009, when the stock market was hitting bottom amid talk of a new depression.

Saturday, July 24, 2010

For Oysters, a ‘Remedy’ Turned Catastrophe

This from The New York Times -- follow link to original

In late April, just days into what has turned out to be the largest oil spill in American history, Gov. Bobby Jindal of Louisiana, with the support of local parish officials, ordered the opening of giant valves on the Mississippi River, releasing torrents of freshwater that they hoped would push oil back out to sea.

Now, reports indicate that the freshwater diversions have had a catastrophic impact on southeastern Louisiana’s oyster beds that is far in excess of the damage done by oil from the spill.

The Associated Press broke the story of the oyster deaths last week, and local news outlets along the coast are following it as well. On Tuesday, The Wall Street Journal chimed in with its own in-depth report.

Oysters require saltwater to live, and major infusions of freshwater can quickly kill them. Once dead, the beds can take two to five years to become commercially viable again.

Now, some oyster fishermen along the coast are reporting mortality rates as high as 80 percent along thousands of acres of oyster beds. In Barataria Bay, one of Louisiana’s most productive oyster fisheries, some beds are 60 percent dead, largely because of the freshwater influx, The Wall Street Journal quoted Louisiana’s top state oyster biologist as saying.

Many oyster beds in gulf waters have been shut down as a precaution because oil contamination was considered likely, but widespread die-offs caused by the oil have not yet been found.

Heavy damage to the oyster beds from the freshwater diversions could prove embarrassing to the Jindal administration, which already finds itself under scrutiny for its ambitious plans to build large sand and rock structures along the coast to block the oil. Both the sand and rock barriers drew criticism from scientists and federal officials that they would have negative environmental consequences that outweighed their potential benefit in stemming the flow of oil.

Such criticisms doomed a plan by the governor to build rock dikes across tidal inlets leading into Barataria Bay but did not stand in the way of the construction of large sand barriers, a project that is still under way in the gulf.

The Jindal administration may already be preparing to deflect criticism over the oyster deaths.

In its article, The Wall Street Journal quotes an unnamed spokesman with the state’s coastal protection authority saying that “rain and the natural flow of the river” were also factors in the decrease in salinity. Attributing specific numbers of oyster deaths to the freshwater diversions would be “difficult,” the spokesman said.

Yet oyster fisheries in nearby Mississippi appear to have been unscathed. “We are finding no major mortalities,” an official with the Mississippi Department of Marine Resources recently told The A.P.

In statements to The A.P. and The Journal, Garrett Graves, chairman of Louisiana’s Coastal Protection and Restoration Authority, and a lead official in the state’s oil spill response, indicated that BP would be held responsible for the damage to the oyster beds caused by the freshwater releases.

103

South Valley Bank & Trust, Klamath Falls, Oregon, Assumes All of the Deposits of Home Valley Bank, Cave Junction, Oregon

FOR IMMEDIATE RELEASE

July 23, 2010

Media Contact:

David Barr

Office Phone: (202) 898-6992

Cell Phone: (703) 622-4790

Email: dbarr@fdic.gov

Home Valley Bank, Cave Junction, Oregon, was closed today by the Oregon Department of Consumer and Business Services, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with South Valley Bank & Trust, Klamath Falls, Oregon, to assume all of the deposits of Home Valley Bank.

The five branches of Home Valley Bank will reopen on Monday as branches of South Valley Bank & Trust. Depositors of Home Valley Bank will automatically become depositors of South Valley Bank & Trust. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship in order to retain their deposit insurance coverage. Customers of Home Valley Bank should continue to use their existing branch until they receive notice from South Valley Bank & Trust that it has completed systems changes to allow other South Valley Bank & Trust branches to process their accounts as well.

This evening and over the weekend, depositors of Home Valley Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of March 31, 2010, Home Valley Bank had approximately $251.80 million in total assets and $229.6 million in total deposits. South Valley Bank & Trust will pay the FDIC a premium of 1.05 percent to assume all of the deposits of Home Valley Bank. In addition to assuming all of the deposits of the failed bank, South Valley Bank & Trust agreed to purchase essentially all of the assets.

The FDIC and South Valley Bank & Trust entered into a loss-share transaction on $211.6 million of Home Valley Bank's assets. South Valley Bank & Trust will share in the losses on the asset pools covered under the loss-share agreement. The loss-share transaction is projected to maximize returns on the assets covered by keeping them in the private sector. The transaction also is expected to minimize disruptions for loan customers. For more information on loss share, please visit: http://www.fdic.gov/bank/individual/failed/lossshare/index.html.

Customers who have questions about today's transaction can call the FDIC toll-free at 1-800-528-4893. The phone number will be operational this evening until 9:00 p.m., Pacific Daylight Time (PDT); on Saturday from 9:00 a.m. to 6:00 p.m., PDT; on Sunday from noon to 6:00 p.m., PDT; and thereafter from 8:00 a.m. to 8:00 p.m., PDT. Interested parties also can visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/homevalleyor.html.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $37.1 million. Compared to other alternatives, South Valley Bank & Trust's acquisition was the least costly resolution for the FDIC's DIF. Home Valley Bank is the 103rd FDIC-insured institution to fail in the nation this year, and the second in Oregon. The last FDIC-insured institution closed in the state was Columbia River Bank, The Dalles, on January 22, 2010.

102

Plaza Bank, Irvine, California, Assumes All of the Deposits of SouthwestUSA Bank, Las Vegas, Nevada

FOR IMMEDIATE RELEASE

July 23, 2010

Media Contact:

David Barr

Office Phone: (202) 898-6992

Cell Phone: (703) 622-4790

Email: dbarr@fdic.gov

SouthwestUSA Bank, Las Vegas, Nevada, was closed today by the Nevada Financial Institutions Division, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Plaza Bank, Irvine, California, to assume all of the deposits of SouthwestUSA Bank.

The sole branch of SouthwestUSA Bank will reopen on Monday as a branch of Plaza Bank. Depositors of SouthwestUSA Bank will automatically become depositors of Plaza Bank. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship in order to retain their deposit insurance coverage. Customers of SouthwestUSA Bank should continue to use their existing branch until they receive notice from Plaza Bank that it has completed systems changes to allow other Plaza Bank branches to process their accounts as well.

This evening and over the weekend, depositors of SouthwestUSA Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of March 31, 2010, SouthwestUSA Bank had approximately $214.0 million in total assets and $186.7 million in total deposits. Plaza Bank did not pay the FDIC a premium for the deposits of SouthwestUSA Bank. In addition to assuming all of the deposits of the failed bank, Plaza Bank agreed to purchase approximately $137.3 million of the failed bank's assets. The FDIC will retain the remaining assets for later disposition.

The FDIC and Plaza Bank entered into a loss-share transaction on $111.3 million of SouthwestUSA Bank's assets. Plaza Bank will share in the losses on the asset pools covered under the loss-share agreement. The loss-share transaction is projected to maximize returns on the assets covered by keeping them in the private sector. The transaction also is expected to minimize disruptions for loan customers. For more information on loss share, please visit: http://www.fdic.gov/bank/individual/failed/lossshare/index.html.

Customers who have questions about today's transaction can call the FDIC toll-free at 1-800-591-2845. The phone number will be operational this evening until 9:00 p.m., Pacific Daylight Time (PDT); on Saturday from 9:00 a.m. to 6:00 p.m., PDT; on Sunday from noon to 6:00 p.m., PDT; and thereafter from 8:00 a.m. to 8:00 p.m., PDT. Interested parties also can visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/southwestusanv.html.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $74.1 million. Compared to other alternatives, Plaza Bank's acquisition was the least costly resolution for the FDIC's DIF. SouthwestUSA Bank is the 102nd FDIC-insured institution to fail in the nation this year, and the fourth in Nevada. The last FDIC-insured institution closed in the state was Nevada Security Bank, Reno, on June 18, 2010.

101

Roundbank, Waseca, Minnesota, Assumes All of the Deposits of Community Security Bank, New Prague, Minnesota

FOR IMMEDIATE RELEASE

July 23, 2010

Media Contact:

David Barr

Office Phone: (202) 898-6992

Cell Phone: (703) 622-4790

Email: dbarr@fdic.gov

Community Security Bank, New Prague, Minnesota, was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Roundbank, Waseca, Minnesota, to assume all of the deposits of Community Security Bank.

The sole branch of Community Security Bank will reopen on Saturday as a branch of Roundbank. Depositors of Community Security Bank will automatically become depositors of Roundbank. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship in order to retain their deposit insurance coverage. Customers of Community Security Bank should continue to use their existing branch until they receive notice from Roundbank that it has completed systems changes to allow other Roundbank branches to process their accounts as well.

This evening and over the weekend, depositors of Community Security Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of March 31, 2010, Community Security Bank had approximately $108.0 million in total assets and $99.7 million in total deposits. Roundbank will pay the FDIC a premium of 0.89 percent to assume all of the deposits of Community Security Bank. In addition to assuming all of the deposits of the failed bank, Roundbank agreed to purchase essentially all of the assets.

Customers who have questions about today's transaction can call the FDIC toll-free at 1-866-692-8944. The phone number will be operational this evening until 9:00 p.m., Central Daylight Time (CDT); on Saturday from 9:00 a.m. to 6:00 p.m., CDT; on Sunday from noon to 6:00 p.m., CDT; and thereafter from 8:00 a.m. to 8:00 p.m., CDT. Interested parties also can visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/communitysecmn.html.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $18.6 million. Compared to other alternatives, Roundbank's acquisition was the least costly resolution for the FDIC's DIF. Community Security Bank is the 101st FDIC-insured institution to fail in the nation this year, and the seventh in Minnesota. The last FDIC-insured institution closed in the state was Pinehurst Bank, St. Paul, on May 21, 2010.

100

The Bennington State Bank, Salina, Kansas, Assumes All of the Deposits of Thunder Bank, Sylvan Grove, Kansas

FOR IMMEDIATE RELEASE

July 23, 2010

Media Contact:

David Barr

Office Phone: (202) 898-6992

Cell Phone: (703) 622-4790

Email: dbarr@fdic.gov

Thunder Bank, Sylvan Grove, Kansas, was closed today by the Kansas Office of the State Bank Commissioner, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with The Bennington State Bank, Salina, Kansas, to assume all of the deposits of Thunder Bank.

The two branches of Thunder Bank will reopen on Monday as branches of The Bennington State Bank. Depositors of Thunder Bank will automatically become depositors of The Bennington State Bank. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship in order to retain their deposit insurance coverage. Customers of Thunder Bank should continue to use their existing branch until they receive notice from The Bennington State Bank that it has completed systems changes to allow other The Bennington State Bank branches to process their accounts as well.

This evening and over the weekend, depositors of Thunder Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of March 31, 2010, Thunder Bank had approximately $32.6 million in total assets and $28.5 million in total deposits. The Bennington State Bank did not pay the FDIC a premium for the deposits of Thunder Bank. In addition to assuming all of the deposits of the failed bank, The Bennington State Bank agreed to purchase essentially all of the assets.

Customers who have questions about today's transaction can call the FDIC toll-free at 1-877-894-4710. The phone number will be operational this evening until 9:00 p.m., Central Daylight Time (CDT); on Saturday from 9:00 a.m. to 6:00 p.m., CDT; on Sunday from noon to 6:00 p.m., CDT; and thereafter from 8:00 a.m. to 8:00 p.m., CDT. Interested parties also can visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/thunderbankks.html.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $4.5 million. Compared to other alternatives, The Bennington State Bank's acquisition was the least costly resolution for the FDIC's DIF. Thunder Bank is the 100th FDIC-insured institution to fail in the nation this year, and the first in Kansas. The last FDIC-insured institution closed in the state was SolutionsBank, Overland Park, on December 11, 2009.

99

First Citizens Bank and Trust Company, Inc., Columbia, South Carolina, Assumes All of the Deposits of Williamsburg First National Bank, Kingstree, South Carolina

FOR IMMEDIATE RELEASE

July 23, 2010

Media Contact:

David Barr

Office Phone: (202) 898-6992

Cell Phone: (703) 622-4790

Email: dbarr@fdic.gov

Williamsburg First National Bank, Kingstree, South Carolina, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with First Citizens Bank and Trust Company, Inc., Columbia, South Carolina, to assume all of the deposits of Williamsburg First National Bank.

The five branches of Williamsburg First National Bank will reopen on Monday as branches of First Citizens Bank and Trust Company, Inc. Depositors of Williamsburg First National Bank will automatically become depositors of First Citizens Bank and Trust Company, Inc. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship in order to retain their deposit insurance coverage. Customers of Williamsburg First National Bank should continue to use their existing branch until they receive notice from First Citizens Bank and Trust Company, Inc. that it has completed systems changes to allow other First Citizens Bank and Trust Company, Inc. branches to process their accounts as well.

This evening and over the weekend, depositors of Williamsburg First National Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of March 31, 2010, Williamsburg First National Bank had approximately $139.3 million in total assets and $134.3 million in total deposits. First Citizens Bank and Trust Company, Inc. will pay the FDIC a premium of 0.5 percent to assume all of the deposits of Williamsburg First National Bank. In addition to assuming all of the deposits of the failed bank, First Citizens Bank and Trust Company, Inc. agreed to purchase essentially all of the assets.

The FDIC and First Citizens Bank and Trust Company, Inc. entered into a loss-share transaction on $64.4 million of Williamsburg First National Bank's assets. First Citizens Bank and Trust Company, Inc. will share in the losses on the asset pools covered under the loss-share agreement. The loss-share transaction is projected to maximize returns on the assets covered by keeping them in the private sector. The transaction also is expected to minimize disruptions for loan customers. For more information on loss share, please visit: http://www.fdic.gov/bank/individual/failed/lossshare/index.html.

Customers who have questions about today's transaction can call the FDIC toll-free at 1-800-523-8209. The phone number will be operational this evening until 9:00 p.m., Eastern Daylight Time (EDT); on Saturday from 9:00 a.m. to 6:00 p.m., EDT; on Sunday from noon to 6:00 p.m., EDT; and thereafter from 8:00 a.m. to 8:00 p.m., EDT. Interested parties also can visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/williamsburgsc.html.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $8.8 million. Compared to other alternatives, First Citizens Bank and Trust Company, Inc.'s acquisition was the least costly resolution for the FDIC's DIF. Williamsburg First National Bank is the 99th FDIC-insured institution to fail in the nation this year, and the fourth in South Carolina. The last FDIC-insured institution closed in the state was Woodlands Bank, Bluffton, on July 16, 2010.

98

Renasant Bank, Tupelo, Mississippi, Assumes All of the Deposits of Crescent Bank and Trust Company, Jasper, Georgia

FOR IMMEDIATE RELEASE

July 23, 2010

Media Contact:

David Barr

Office Phone: (202) 898-6992

Cell Phone: (703) 622-4790

Email: dbarr@fdic.gov

Crescent Bank and Trust Company, Jasper, Georgia, was closed today by the Georgia Department of Banking & Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Renasant Bank, Tupelo, Mississippi, to assume all of the deposits of Crescent Bank and Trust Company.

The 11 branches of Crescent Bank and Trust Company will reopen under normal business hours beginning Saturday as branches of Renasant Bank. Depositors of Crescent Bank and Trust Company will automatically become depositors of Renasant Bank. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship in order to retain their deposit insurance coverage. Customers of Crescent Bank and Trust Company should continue to use their existing branch until they receive notice from Renasant Bank that it has completed systems changes to allow other Renasant Bank branches to process their accounts as well.

This evening and over the weekend, depositors of Crescent Bank and Trust Company can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of March 31, 2010, Crescent Bank and Trust Company had approximately $1.01 billion in total assets and $965.7 million in total deposits. Renasant Bank will pay the FDIC a premium of 1.0 percent to assume all of the deposits of Crescent Bank and Trust Company. In addition to assuming all of the deposits of the failed bank, Renasant Bank agreed to purchase essentially all of the assets.

The FDIC and Renasant Bank entered into a loss-share transaction on $617.4 million of Crescent Bank and Trust Company's assets. Renasant Bank will share in the losses on the asset pools covered under the loss-share agreement. The loss-share transaction is projected to maximize returns on the assets covered by keeping them in the private sector. The transaction also is expected to minimize disruptions for loan customers. For more information on loss share, please visit: http://www.fdic.gov/bank/individual/failed/lossshare/index.html.

Customers who have questions about today's transaction can call the FDIC toll-free at 1-800-523-8177. The phone number will be operational this evening until 9:00 p.m., Eastern Daylight Time (EDT); on Saturday from 9:00 a.m. to 6:00 p.m., EDT; on Sunday from noon to 6:00 p.m., EDT; and thereafter from 8:00 a.m. to 8:00 p.m., EDT. Interested parties also can visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/crescentga.html.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $242.4 million. Compared to other alternatives, Renasant Bank's acquisition was the least costly resolution for the FDIC's DIF. Crescent Bank and Trust Company is the 98th FDIC-insured institution to fail in the nation this year, and the tenth in Georgia. The last FDIC-insured institution closed in the state was First National Bank, Savannah, on June 25, 2010.

97

IBERIABANK, Lafayette, Louisiana, Assumes All of the Deposits of Sterling Bank, Lantana, Florida

FOR IMMEDIATE RELEASE

July 23, 2010

Media Contact:

David Barr

Office Phone: (202) 898-6992

Cell Phone: (703) 622-4790

Email: dbarr@fdic.gov

Sterling Bank, Lantana, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with IBERIABANK, Lafayette, Louisiana, to assume all of the deposits of Sterling Bank.

The six branches of Sterling Bank will reopen on Monday as branches of IBERIABANK. Depositors of Sterling Bank will automatically become depositors of IBERIABANK. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship in order to retain their deposit insurance coverage. Customers of Sterling Bank should continue to use their existing branch until they receive notice from IBERIABANK that it has completed systems changes to allow other IBERIABANK branches to process their accounts as well.

This evening and over the weekend, depositors of Sterling Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of March 31, 2010, Sterling Bank had approximately $407.9 million in total assets and $372.4 million in total deposits. IBERIABANK did not pay the FDIC a premium for the deposits of Sterling Bank. In addition to assuming all of the deposits of the failed bank, IBERIABANK agreed to purchase essentially all of the assets.

The FDIC and IBERIABANK entered into a loss-share transaction on $244.3 million of Sterling Bank's assets. IBERIABANK will share in the losses on the asset pools covered under the loss-share agreement. The loss-share transaction is projected to maximize returns on the assets covered by keeping them in the private sector. The transaction also is expected to minimize disruptions for loan customers. For more information on loss share, please visit: http://www.fdic.gov/bank/individual/failed/lossshare/index.html.

Customers who have questions about today's transaction can call the FDIC toll-free at 1-800-523-8275. The phone number will be operational this evening until 9:00 p.m., Eastern Daylight Time (EDT); on Saturday from 9:00 a.m. to 6:00 p.m., EDT; on Sunday from noon to 6:00 p.m., EDT; and thereafter from 8:00 a.m. to 8:00 p.m., EDT. Interested parties also can visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/sterlingfl.html.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $45.5 million. Compared to other alternatives, IBERIABANK's acquisition was the least costly resolution for the FDIC's DIF. Sterling Bank is the 97th FDIC-insured institution to fail in the nation this year, and the eighteenth in Florida. The last FDIC-insured institution closed in the state was Metro Bank of Dade County, Miami, on July 16, 2010.

Thursday, July 22, 2010

State of the Climate Global Analysis June 2010

Please follow link to original

State of the Climate

Global Analysis

June 2010

National Oceanic and Atmospheric Administration

National Climatic Data Center

May 2010

Global Analysis Report

Report:

Global Highlights

* The combined global land and ocean average surface temperature for June 2010 was the warmest on record at 16.2°C (61.1°F), which is 0.68°C (1.22°F) above the 20th century average of 15.5°C (59.9°F). The previous record for June was set in 2005.

* June 2010 was the fourth consecutive warmest month on record (March, April, and May 2010 were also the warmest on record). This was the 304th consecutive month with a global temperature above the 20th century average. The last month with below-average temperature was February 1985.

* The June worldwide averaged land surface temperature was 1.07°C (1.93°F) above the 20th century average of 13.3°C (55.9°F)—the warmest on record.

* It was the warmest April–June (three-month period) on record for the global land and ocean temperature and the land-only temperature. The three-month period was the second warmest for the world's oceans, behind 1998.

* It was the warmest June and April–June on record for the Northern Hemisphere as a whole and all land areas of the Northern Hemisphere.

* It was the warmest January–June on record for the global land and ocean temperature. The worldwide land on average had its second warmest January–June, behind 2007. The worldwide averaged ocean temperature was the second warmest January–June, behind 1998.

* Sea surface temperature (SST) anomalies in the central and eastern equatorial Pacific Ocean continued to decrease during June 2010. According to NOAA's Climate Prediction Center, La Niña conditions are likely to develop during the Northern Hemisphere summer 2010.

Wednesday, July 21, 2010

Sunday, July 18, 2010

Stimulus Despair

Paul Krugman - New York Times Blog

New York Times Blog

July 18, 2010, 10:46 am

More Stimulus Despair

I’ll be frank: the discussion of fiscal stimulus this past year and a half has filled me with despair over the state of the economics profession. If you believe stimulus is a bad idea, fine; but surely the least one could have expected is that opponents would listen, even a bit, to what proponents were saying. In particular, the case for stimulus has always been highly conditional. Fiscal stimulus is what you do only if two conditions are satisfied: high unemployment, so that the proximate risk is deflation, not inflation; and monetary policy constrained by the zero lower bound.

That doesn’t sound like a hard point to grasp. Yet again and again, critics point to examples of increased government spending under conditions nothing like that, and claim that these examples somehow prove something.

Here’s the latest, from Tyler Cowen:

Certainly, in Germany, the recent history of fiscal stimulus wasn’t entirely positive. After reunification in 1990, the German government borrowed and spent huge amounts of money to finance reconstruction and to bring East German living standards up to West German levels. Millions of new consumers were added to the economy.

These policies did unify the country politically but were not overwhelmingly successful economically. An initial surge was followed by years of disappointing results for output and employment.

This passage makes me want to stick a pencil in my eye. Let’s consider the case:

1. This was not an effort at fiscal stimulus; it was a supply policy, not a demand policy. The German government wasn’t trying to pump up demand — it was trying to rebuild East German infrastructure to raise the region’s productivity.

2. The West German economy was not suffering from high unemployment — on the contrary, it was running hot, and the Bundesbank feared inflation.

3. The zero lower bound was not a concern. In fact, the Bundesbank was in the process of raising rates to head off inflation risks — the discount rate went from 4 percent in early 1989 to 8.75 percent in the summer of 1992. In part, this rate rise was a deliberate effort to choke off the additional demand created by spending on East Germany, to such an extent that the German mix of deficit spending and tight money is widely blamed for the European exchange rate crises of 1992-1993.

In short, it’s hard to think of a case less suited to tell us anything at all about fiscal stimulus under the conditions we now face. And the fact that a prominent commentator on current events apparently doesn’t know that, after a year and a half of debating this issue — well, as I said, I’m feeling fairly despairing.

Saturday, July 17, 2010

The Theft of The American Dream

FOLLOW THE LINK AND BOOKMARK THE BLOG!

17 July 2010

Nothing Was Sacred: The Theft of the American Dream

America must decide what type of country it wishes to be, and then conform public and foreign policy to those ends, and not the other way around. Politicians have no right to subjugate the constitutional process of government to any foreign organization.

Secrecy, except in very select military matters, is repugnant to the health of a democratic government, and is almost always a means to conceal a fraud. Corporations are not people, and do not have the rights of individuals as such.

Banks are utilities for the rational allocation of capital created by savings, and as utilities deserve special protections. All else is speculation and gambling. In banking, simpler and more stable is better. Low cost rules, as excessive financialisation is a pernicious tax on the real economy.

Financial speculation, as opposed to entrepreneurial investment, creates little value, serving largely to transfer wealth from the many to the few, often by exploiting the weak, and corrupting the law. It does serve to identify and correct market inefficiencies, but this benefit is vastly overrated, because those are quickly eliminated. As such it should be allowed, but tightly regulated and highly taxed as a form of gambling.

When the oligarchy's enablers, hired help is the politer word, and assorted useful idiots ask, "But how then will we do this or that?" ask them back, "How did we do it twenty years ago?" Before the financial revolution and the descent into a bubble economy and a secretive and largely corrupted government with a GDP whose primary product is fraud.

Other nations, such as China, are surely acting for their own interests, and in many cases the interests of their people, much more diligently and effectively than the kleptocrats who are in power in Washington and New York these days. How then could we possibly subvert the Constitution and the welfare of the people to unelected foreign organizations? If this requires a greater reliance on self-sufficiency, then so be it. America is large enough to see to its own, as the others see to theirs.

Economics will not provide any answers in and of itself. Economics without an a priori policy and morality, without a guiding principle like the Constitution, is a heartless monster easily manipulated to say whatever one wishes it to say, if they are willing to pay enough economists to say it. Its reputation as a science is greatly exaggerated.

"Eliminating government" is a trap put forward by the plutocrats for those unable to reason except by prejudice, as they desire to exercise their power unimpeded by the rule of law. Once you knock down the protections and the safeguards in the name of reform, the wolves will turn on the public in an orgy of looting and exploitation. This is an old story, and sadly it often works.

Efficient markets hypothesis is almost as great a hoax as the benefits of globalization and 'free trade' have been to the American people as a whole. These things are promoted by the few, at the expense of the gullible many, for their own personal benefit.

Hatred, mean spiritedness, and resentment of the weak, the old, the different, is a trick played on the masses by oligarchs and would be dictators from time immemorial. They play to the darker side of the crowd. It is a trap, and the means to the demise of freedom. And these tricksters play it well, because deceit is their specialty, their stock in trade.

"First they ignore you, then they ridicule you, then they fight you, then you win." - Mohandas K. Gandhi

So it will not be easy, and it is a mistake to think that it will be. But what greater task can we set ourselves to, other than justice and freedom for ourselves and children?

"It's The End Of The World As We Know It."

It's time to make some changes. Time to elect some folks who actually give a shit about the USA and its citizens.

It’s the End of the World As We Know It

By Phil of Phil’s Stock World

What are 308,367,109 Americans supposed to do?

First of all, despite clamping down on immigration, our population grew by 2.6M people last year. Unfortunately, not only did we not create jobs for those 2.6M new people but we lost about 4M jobs so what are these new people going to do? Not only that, but nobody is talking about the another major job issue: People aren’t retiring! They can’t afford to because the economy is bad – that means there are even less job openings… The pimply faced kid can’t get a job delivering pizza because his grandpa’s doing it.

There are some brilliant pundits who believe cutting retirement benefits will fix our economy. How will that work exactly? Pay old people less money, don’t cover their medical care and what happens? Then they need money. If they need money, they need to work and if they need to work they increase the supply of labor, which reduces wages and leaves all 308,367,109 of us with less money. Oh sorry, not ALL 308,367,109 – just 308,337,109 – the top 30,000 (0.01%) own the business the other 308,337,109 work at and they will be raking it in because labor is roughly 1/3 of the cost of doing business in America and our great and powerful capitalists have already cut their manufacturing costs by shipping all those jobs overseas, where they pay as little as $1 a day for a human life so now, in order to increase their profits (because profits MUST be increased) they have now turned inward to see what they can shave off in America.

How does one decrease the cost of labor in America? Well first, you have to bust the unions. Check. Then you have to create a pressing need for people to work – perhaps give them easy access to credit and then get them to go so deeply into debt that they will have to work until they die to pay them off. Check. It also helps if you push up the cost of living by manipulating commodity prices. Check. Then, take away people’s retirement savings. Check. Lower interest rates to make savings futile and interest income inadequate. Check. And finally, threaten to take away the 12% a year that people have been saving for retirement by labeling Social Security an “entitlement” program – as if it wasn’t money Americans worked their whole lives to save and gave to the government in good faith. Check.

As Allen Smith says: “Ronald Reagan and Alan Greenspan pulled off one of the greatest frauds ever perpetrated against the American people in the history of this great nation, and the underlying scam is still alive and well, more than a quarter century later. It represents the very foundation upon which the economic malpractice that led the nation to the great economic collapse of 2008 was built. Essentially, Reagan switched the federal government from what he critically called, a “tax and spend” policy, to a “borrow and spend” policy, where the government continued its heavy spending, but used borrowed money instead of tax revenue to pay the bills. The results were catastrophic. Although it had taken the United States more than 200 years to accumulate the first $1 trillion of national debt, it took only five years under Reagan to add the second one trillion dollars to the debt. By the end of the 12 years of the Reagan-Bush administrations, the national debt had quadrupled to $4 trillion!“

Both Reagan and Greenspan saw big government as an evil, and they saw big business as a virtue. They both had despised the progressive policies of Roosevelt, Kennedy and Johnson, and they wanted to turn back the pages of time. They came up with the perfect strategy for the redistribution of income and wealth from the working class to the rich. If Reagan had campaigned for the presidency by promising big tax cuts for the rich and pledging to make up for the lost revenue by imposing substantial tax increases on the working class, he would probably not have been elected. But that is exactly what Reagan did, with the help of Alan Greenspan. Consider the following sequence of events:

1) President Reagan appointed Greenspan as chairman of the 1982 National Commission on Social Security Reform (aka The Greenspan Commission)

2) The Greenspan Commission recommended a major payroll tax hike to generate Social Security surpluses for the next 30 years, in order to build up a large reserve in the trust fund that could be drawn down during the years after Social Security began running deficits.

3) The 1983 Social Security amendments enacted hefty increases in the payroll tax in order to generate large future surpluses.

4) As soon as the first surpluses began to role in, in 1985, the money was put into the general revenue fund and spent on other government programs. None of the surplus was saved or invested in anything. The surplus Social Security revenue, that was paid by working Americans, was used to replace the lost revenue from Reagan’s big income tax cuts that went primarily to the rich.

5) In 1987, President Reagan nominated Greenspan as the successor to Paul Volcker as chairman of the Federal Reserve Board. Greenspan continued as Fed Chairman until January 31, 2006. (One can only speculate on whether the coveted Fed Chairmanship represented, at least in part, a payback for Greenspan’s role in initiating the Social Security surplus revenue.)

6) In 1990, Senator Daniel Patrick Moynihan of New York, a member of the Greenspan Commission, and one of the strongest advocates the 1983 legislation, became outraged when he learned that first Reagan, and then President George H.W. Bush used the surplus Social Security revenue to pay for other government programs instead of saving and investing it for the baby boomers. Moynihan locked horns with President Bush and proposed repealing the 1983 payroll tax hike. Moynihan’s view was that if the government could not keep its hands out of the Social Security cookie jar, the cookie jar should be emptied, so there would be no surplus Social Security revenue for the government to loot. President Bush would have no part of repealing the payroll tax hike. The “read-my-lips-no-new-taxes” president was not about to give up his huge slush fund.

The practice of using every dollar of the surplus Social Security revenue for general government spending continues to this day. The 1983 payroll tax hike has generated approximately $2.5 trillion in surplus Social Security revenue which is supposed to be in the trust fund for use in paying for the retirement benefits of the baby boomers. But the trust fund is empty! It contains no real assets. As a result, the government will soon be unable to pay full benefits without a tax increase. Money can be spent or it can be saved. But you can’t do both. Absolutely none of the $2.5 trillion was saved or invested in anything.

That is how the largest theft in the history of the world was carried out. 300M people worked and saved their whole lives to set aside $2.5Tn into a retirement system that, if it were paying a fair compounding rate of 5% interest over 40 years of labor (assuming an even $62Bn a year was contributed), would be worth $8.4Tn today – enough money to give 100M workers $84,000 each in cash! The looting of FICA hid the massive deficits of the last 30 years in the Unified Budget. Presidents and Congresses were able to reduce taxes on the wealthiest Americans without complaint from the deficit hawks, because they benefited. The money went directly from the pockets of average Americans into the pockets of the rich.

Now that it is time to repay those special bonds in the Trust Fund, we are inundated in opinion pieces in the leading newspapers and magazines complaining about Social Security and its horrible impact on the budget. Government finances have been trashed by foolish tax cuts, unpaid wars, tax loopholes for corporations and the very wealthy, the failures of economists, the greedy search for greater returns in financial markets and the collapse of moral values in giant businesses, but Social Security is supposed to be the problem that needs fixing…

Social Security is not “broken“–the money is in the Trust Fund. But the people who manage the finances of the United States don’t want to repay the bonds held by the Trust Fund. They want to default selectively against average people, their fellow citizens, who paid their taxes expecting to be protected in their retirement. Refusing to repay the $2.54 trillion dollars in bonds held by the Social Security Trust makes the US look like Greece, just another nation unable to govern itself coherently. The people who manage US finances come from the financial elites, the best that Wall Street and enormous corporations have to offer. Selective default exposes them as charlatans. The claims of the economics profession to expertise are puffery. Their theories about the benefits of tax cuts are proven false. Their mathematical proofs about free markets collapse in the real world.

So, what is this all about? It’s about forcing 5M people a year who reach the age 65 to remain in the work-force. The top 0.01% have already taken your money, they have already put you in debt, they have already bankrupted the government as well so it has no choice but to do their bidding. Now the top 0.01% want to make even MORE profits by paying American workers even LESS money. If they raise the retirement age to 70 to “balance” Social Security – that will guarantee that another 25M people remain in the workforce (less the ones that drop dead on the job – saving the bother of paying them severance).

What’s next? Is it fair to say that children can’t work in a struggling family business? Isn’t it to everybody’s benefit that kids should be allowed to help out at the family store? That will be the next step towards turning America into a 3rd World country. The seemingly innocent concept of “letting” kids work will deprive another 5M people of paying jobs – throwing them out into the labor force as well and driving labor costs down even further.

There’s an expression that goes “give them an inch and they’ll take a yard.” The top 0.01% of this country have taken their inches and they are foreclosing on the yards and they will come for the rest of your stuff next. If you think you are “safe” from the looting of America, it is only because they haven’t gotten around to you yet. As I explained in “America is 234 Years Old Today – Is It Finished?” – the game is rigged very much like a poker tournament. The people at the top table don’t care how well you do wiping out your fellow players at the lower tables, they know they will get you eventually and your efforts to scoop up a pile of cash for yourself simply makes their job easier when they are ready to take it from you.

The average American is $634,000 in debt thanks to the efforts that Reagan and Greenspan put in motion 30 years ago and the richer you are, the more of that money is going to come out of your hide eventually and the more you lobby to make sure that the “rich” are not taxed unfairly, the less fair it will be to you because, no matter how rich you THINK you are, unless your income is measured in MILLIONS PER MONTH, you aren’t even close to the top 30,000.

No progressive tax? That means that people and corporations who make $1M PER DAY should pay no more tax than a person making $1M per year, right? Well that means that the $2.5M debt that your family of four owes will be paid by you over 2.5 years of labor while the $2.5M owed by your Billionaire competitor will be paid over a long weekend, after which he can turn his attention back to crushing your business by creating cheaper goods – maintaining profit margins by driving down local labor costs and outsourcing the rest.

It’s a new world, America, and you’d better get used to it – we were sold down the river on a slow boat to China long ago and we’re only just beginning to feel the first effects of waves that wash back to our own shores. The people who own the media don’t want CHANGE. That’s why you never hear this stuff in the MSM – things are going exactly according to plan and the old money crowd is playing a long, patient game and they already have most of the chips – the last thing they want is people questioning the system…

Friday, July 16, 2010

96

Commercial Bank, Alma, Michigan, Assumes All of the Deposits of Mainstreet Savings Bank, FSB

FOR IMMEDIATE RELEASE

July 16, 2010

Media Contact:

Greg Hernandez (202) 898-6984

Cell: (202) 340-4922

Email: ghernandez@fdic.gov

Mainstreet Savings Bank, FSB, Hastings, Michigan, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Commercial Bank, Alma, Michigan, to assume all of the deposits of Mainstreet Savings Bank, FSB.

The two branches of Mainstreet Savings Bank, FSB will reopen on Saturday as branches of Commercial Bank. Depositors of Mainstreet Savings Bank, FSB will automatically become depositors of Commercial Bank. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship in order to retain their deposit insurance coverage. Customers of Mainstreet Savings Bank, FSB should continue to use their existing branch until they receive notice from Commercial Bank that it has completed systems changes to allow other Commercial Bank branches to process their accounts as well.

This evening and over the weekend, depositors of Mainstreet Savings Bank, FSB can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of March 31, 2010, Mainstreet Savings Bank, FSB had approximately $97.4 million in total assets and $63.7 million in total deposits. Commercial Bank will pay the FDIC a premium of 1.13 percent to assume all of the deposits of Mainstreet Savings Bank, FSB. In addition to assuming all of the deposits of the failed bank, Commercial Bank agreed to purchase essentially all of the assets.

The FDIC and Commercial Bank entered into a loss-share transaction on $77.1 million of Mainstreet Savings Bank, FSB's assets. Commercial Bank will share in the losses on the asset pools covered under the loss-share agreement. The loss-share transaction is projected to maximiz returns on the assets covered by keeping them in the private sector. The transaction also is expected to minimize disruptions for loan customers. For more information on loss share, please visit: http://www.fdic.gov/bank/individual/failed/lossshare/index.html.

Customers who have questions about today's transaction can call the FDIC toll-free at 1-800-451-1093. The phone number will be operational this evening until 9:00 p.m., Eastern Daylight Time (EDT); on Saturday from 9:00 a.m. to 6:00 p.m., EDT; on Sunday from noon to 6:00 p.m., EDT; and thereafter from 8:00 a.m. to 8:00 p.m., EDT. Interested parties also can visit the FDIC's Web site at http://www.fdic.gov/bank/individual/failed/mainstsvgs.html.

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.4 million. Compared to other alternatives, Commercial Bank's acquisition was the "least costly" resolution for the FDIC's DIF. Mainstreet Savings Bank, FSB is the 96th FDIC-insured institution to fail in the nation this year, and the fourth in Michigan. The last FDIC-insured institution closed in the state was New Liberty Bank, Plymouth, on May 14, 2010.