Friday, March 28, 2014

Wednesday, March 26, 2014

What America Isn’t, Or Anyway Wasn’t

Here's an interesting post from Dr. Krugman's blog -- please follow link to original

---------------------------------------------------------------------

http://krugman.blogs.nytimes.com/

---------------------------------------------------------------------

http://krugman.blogs.nytimes.com/

I get mail:

Paul you are a subhuman communist traitor who should be deported. You are a disgrace to america’s founders and an affront to the Constitution. Republicans believe in protecting the money of WORKERS not RECEIVERS. All workers, poor and rich, should be protected from high taxes equally.

Well, I get at least one of these each day. But it’s kind of interesting to read this right after reviewing Piketty,

because one point Piketty makes is that the modern notion that

redistribution and “penalizing success” is un- and anti-American is

completely at odds with our country’s actual history. One subsection in

Piketty’s book is titled “Confiscatory Taxation of Excess Incomes: An

American Invention”; he shows that America actually pioneered very high

taxes on the rich:

When we look at the history of progressive taxation in the twentieth century, it is striking to see how far out in front Britain and the United States were, especially the latter, which invented the confiscatory tax on “excessive” incomes and fortunes.

Why was this the case? Piketty points to the

American egalitarian ideal, which went along with fear of creating a

hereditary aristocracy. High taxes, especially on estates, were

motivated in part by “fear of coming to resemble Old Europe.” Among

those who called for high estate taxation on social and political

grounds was the great economist Irving Fisher.

Just to reemphasize the point: during the

Progressive Era, it was commonplace and widely accepted to support high

taxes on the rich specifically in order to keep the rich from getting

richer — a position that few people in politics today would dare

espouse.

And as my correspondent so vividly

illustrates, many people nowadays imagine that redistribution and high

taxes on the rich are antithetical to American ideals, indeed

practically communism. They have no idea (and wouldn’t believe) that

redistribution is in reality as American as apple pie.

Tuesday, March 25, 2014

The New Tribalism and the Decline of the Nation State

This from Robert Reich. Please follow link to original.

---------------------------------------------------

http://robertreich.org/

---------------------------------------------------

http://robertreich.org/

We are witnessing a reversion to tribalism

around the world, away from nation states. The the same pattern can be

seen even in America – especially in American politics.

Before the rise of the nation-state, between the eighteenth and twentieth centuries, the world was mostly tribal. Tribes were united by language, religion, blood, and belief. They feared other tribes and often warred against them. Kings and emperors imposed temporary truces, at most.

But in the past three hundred years the idea of nationhood took root in most of the world. Members of tribes started to become citizens, viewing themselves as a single people with patriotic sentiments and duties toward their homeland. Although nationalism never fully supplanted tribalism in some former colonial territories, the transition from tribe to nation was mostly completed by the mid twentieth century.

Over the last several decades, though, technology has whittled away the underpinnings of the nation state. National economies have become so intertwined that economic security depends less on national armies than on financial transactions around the world. Global corporations play nations off against each other to get the best deals on taxes and regulations.

News and images move so easily across borders that attitudes and aspirations are no longer especially national. Cyber-weapons, no longer the exclusive province of national governments, can originate in a hacker’s garage.

Nations are becoming less relevant in a world where everyone and everything is interconnected. The connections that matter most are again becoming more personal. Religious beliefs and affiliations, the nuances of one’s own language and culture, the daily realities of class, and the extensions of one’s family and its values – all are providing people with ever greater senses of identity.

The nation state, meanwhile, is coming apart. A single Europe – which seemed within reach a few years ago – is now succumbing to the centrifugal forces of its different languages and cultures. The Soviet Union is gone, replaced by nations split along tribal lines. Vladimir Putin can’t easily annex the whole of Ukraine, only the Russian-speaking part. The Balkans have been Balkanized.

Separatist movements have broken out all over — Czechs separating from Slovaks; Kurds wanting to separate from Iraq, Syria, and Turkey; even the Scots seeking separation from England.

The turmoil now consuming much of the Middle East stems less from democratic movements trying to topple dictatorships than from ancient tribal conflicts between the two major denominations of Isam – Sunni and Shia.

And what about America? The world’s “melting pot” is changing color. Between the 2000 and 2010 census the share of the U.S. population calling itself white dropped from 69 to 64 percent, and more than half of the nation’s population growth came from Hispanics.

It’s also becoming more divided by economic class. Increasingly, the rich seem to inhabit a different country than the rest.

But America’s new tribalism can be seen most distinctly in its politics. Nowadays the members of one tribe (calling themselves liberals, progressives, and Democrats) hold sharply different views and values than the members of the other (conservatives, Tea Partiers, and Republicans).

Each tribe has contrasting ideas about rights and freedoms (for liberals, reproductive rights and equal marriage rights; for conservatives, the right to own a gun and do what you want with your property).

Each has its own totems (social insurance versus smaller government) and taboos (cutting entitlements or raising taxes). Each, its own demons (the Tea Party and Ted Cruz; the Affordable Care Act and Barack Obama); its own version of truth (one believes in climate change and evolution; the other doesn’t); and its own media that confirm its beliefs.

The tribes even look different. One is becoming blacker, browner, and more feminine. The other, whiter and more male. (Only 2 percent of Mitt Romney’s voters were African-American, for example.)

Each tribe is headed by rival warlords whose fighting has almost brought the national government in Washington to a halt. Increasingly, the two tribes live separately in their own regions – blue or red state, coastal or mid-section, urban or rural – with state or local governments reflecting their contrasting values.

I’m not making a claim of moral equivalence. Personally, I think the Republican right has gone off the deep end, and if polls are to be believed a majority of Americans agree with me.

But the fact is, the two tribes are pulling America apart, often putting tribal goals over the national interest – which is not that different from what’s happening in the rest of the world.

Before the rise of the nation-state, between the eighteenth and twentieth centuries, the world was mostly tribal. Tribes were united by language, religion, blood, and belief. They feared other tribes and often warred against them. Kings and emperors imposed temporary truces, at most.

But in the past three hundred years the idea of nationhood took root in most of the world. Members of tribes started to become citizens, viewing themselves as a single people with patriotic sentiments and duties toward their homeland. Although nationalism never fully supplanted tribalism in some former colonial territories, the transition from tribe to nation was mostly completed by the mid twentieth century.

Over the last several decades, though, technology has whittled away the underpinnings of the nation state. National economies have become so intertwined that economic security depends less on national armies than on financial transactions around the world. Global corporations play nations off against each other to get the best deals on taxes and regulations.

News and images move so easily across borders that attitudes and aspirations are no longer especially national. Cyber-weapons, no longer the exclusive province of national governments, can originate in a hacker’s garage.

Nations are becoming less relevant in a world where everyone and everything is interconnected. The connections that matter most are again becoming more personal. Religious beliefs and affiliations, the nuances of one’s own language and culture, the daily realities of class, and the extensions of one’s family and its values – all are providing people with ever greater senses of identity.

The nation state, meanwhile, is coming apart. A single Europe – which seemed within reach a few years ago – is now succumbing to the centrifugal forces of its different languages and cultures. The Soviet Union is gone, replaced by nations split along tribal lines. Vladimir Putin can’t easily annex the whole of Ukraine, only the Russian-speaking part. The Balkans have been Balkanized.

Separatist movements have broken out all over — Czechs separating from Slovaks; Kurds wanting to separate from Iraq, Syria, and Turkey; even the Scots seeking separation from England.

The turmoil now consuming much of the Middle East stems less from democratic movements trying to topple dictatorships than from ancient tribal conflicts between the two major denominations of Isam – Sunni and Shia.

And what about America? The world’s “melting pot” is changing color. Between the 2000 and 2010 census the share of the U.S. population calling itself white dropped from 69 to 64 percent, and more than half of the nation’s population growth came from Hispanics.

It’s also becoming more divided by economic class. Increasingly, the rich seem to inhabit a different country than the rest.

But America’s new tribalism can be seen most distinctly in its politics. Nowadays the members of one tribe (calling themselves liberals, progressives, and Democrats) hold sharply different views and values than the members of the other (conservatives, Tea Partiers, and Republicans).

Each tribe has contrasting ideas about rights and freedoms (for liberals, reproductive rights and equal marriage rights; for conservatives, the right to own a gun and do what you want with your property).

Each has its own totems (social insurance versus smaller government) and taboos (cutting entitlements or raising taxes). Each, its own demons (the Tea Party and Ted Cruz; the Affordable Care Act and Barack Obama); its own version of truth (one believes in climate change and evolution; the other doesn’t); and its own media that confirm its beliefs.

The tribes even look different. One is becoming blacker, browner, and more feminine. The other, whiter and more male. (Only 2 percent of Mitt Romney’s voters were African-American, for example.)

Each tribe is headed by rival warlords whose fighting has almost brought the national government in Washington to a halt. Increasingly, the two tribes live separately in their own regions – blue or red state, coastal or mid-section, urban or rural – with state or local governments reflecting their contrasting values.

I’m not making a claim of moral equivalence. Personally, I think the Republican right has gone off the deep end, and if polls are to be believed a majority of Americans agree with me.

But the fact is, the two tribes are pulling America apart, often putting tribal goals over the national interest – which is not that different from what’s happening in the rest of the world.

Monday, March 24, 2014

Wealth Over Work

The latest from Prof. Krugman - follow link to original

------------------------------------------------------------------

http://www.nytimes.com/2014/03/24/opinion/krugman-wealth-over-work.html?ref=paulkrugman&_r=0

------------------------------------------------------------------

http://www.nytimes.com/2014/03/24/opinion/krugman-wealth-over-work.html?ref=paulkrugman&_r=0

It seems safe to say that “Capital in the Twenty-First Century,” the magnum opus of the French economist Thomas Piketty,

will be the most important economics book of the year — and maybe of

the decade. Mr. Piketty, arguably the world’s leading expert on income

and wealth inequality, does more than document the growing concentration

of income in the hands of a small economic elite. He also makes a

powerful case that we’re on the way back to “patrimonial capitalism,” in

which the commanding heights of the economy are dominated not just by

wealth, but also by inherited wealth, in which birth matters more than

effort and talent.

To

be sure, Mr. Piketty concedes that we aren’t there yet. So far, the

rise of America’s 1 percent has mainly been driven by executive salaries

and bonuses rather than income from investments, let alone inherited

wealth. But six of the 10 wealthiest Americans

are already heirs rather than self-made entrepreneurs, and the children

of today’s economic elite start from a position of immense privilege.

As Mr. Piketty notes, “the risk of a drift toward oligarchy is real and

gives little reason for optimism.”

Indeed.

And if you want to feel even less optimistic, consider what many U.S.

politicians are up to. America’s nascent oligarchy may not yet be fully

formed — but one of our two main political parties already seems

committed to defending the oligarchy’s interests.

Despite the frantic efforts of some Republicans

to pretend otherwise, most people realize that today’s G.O.P. favors

the interests of the rich over those of ordinary families. I suspect,

however, that fewer people realize the extent to which the party favors

returns on wealth over wages and salaries. And the dominance of income

from capital, which can be inherited, over wages — the dominance of

wealth over work — is what patrimonial capitalism is all about.

To

see what I’m talking about, start with actual policies and policy

proposals. It’s generally understood that George W. Bush did all he

could to cut taxes on the very affluent, that the middle-class cuts he

included were essentially political loss leaders. It’s less well

understood that the biggest breaks went not to people paid high salaries

but to coupon-clippers and heirs to large estates. True, the top tax

bracket on earned income fell from 39.6 to 35 percent. But the top rate

on dividends fell from 39.6 percent (because they were taxed as ordinary income) to 15 percent — and the estate tax was completely eliminated.

Some

of these cuts were reversed under President Obama, but the point is

that the great tax-cut push of the Bush years was mainly about reducing

taxes on unearned income. And when Republicans retook one house of

Congress, they promptly came up with a plan — Representative Paul Ryan’s

“road map”

— calling for the elimination of taxes on interest, dividends, capital

gains and estates. Under this plan, someone living solely off inherited

wealth would have owed no federal taxes at all.

This tilt of policy toward the interests of wealth has been mirrored by a

tilt in rhetoric; Republicans often seem so intent on exalting “job

creators” that they forget to mention American workers. In 2012

Representative Eric Cantor, the House majority leader, famously

commemorated Labor Day with a Twitter post honoring business owners. More recently, Mr. Cantor reportedly reminded colleagues at a G.O.P. retreat

that most Americans work for other people, which is at least one reason

attempts to make a big issue out of Mr. Obama’s supposed denigration of

businesspeople fell flat. (Another reason was that Mr. Obama did no

such thing.)

In fact, not only don’t most Americans own businesses, but business income,

and income from capital in general, is increasingly concentrated in the

hands of a few people. In 1979 the top 1 percent of households

accounted for 17 percent of business income; by 2007 the same group was

getting 43 percent of business income, and 75 percent of capital gains.

Yet this small elite gets all of the G.O.P.’s love, and most of its

policy attention.

Why

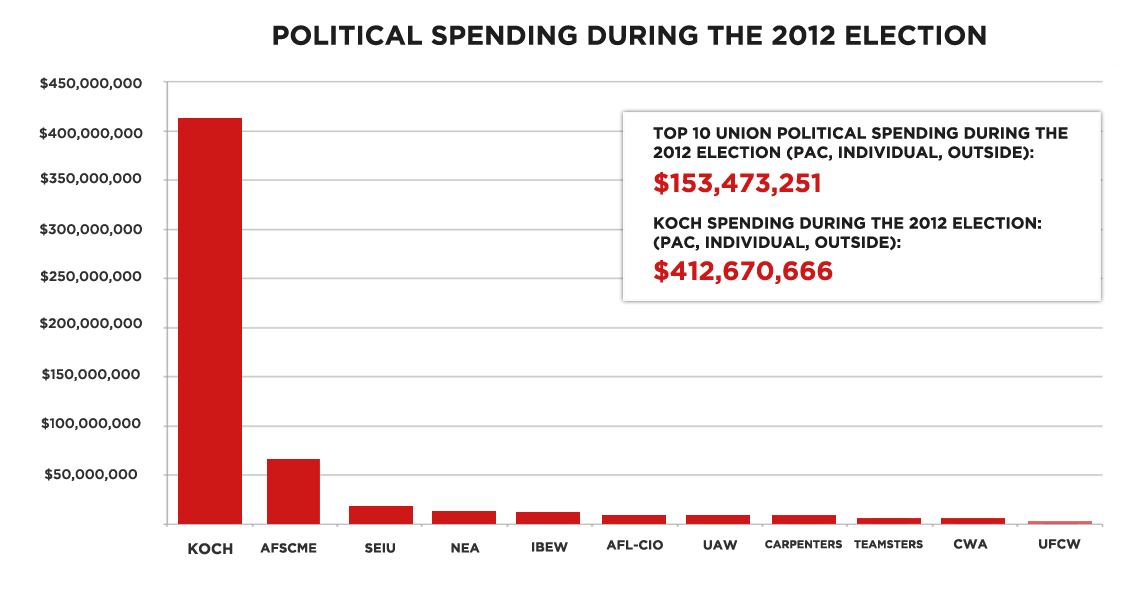

is this happening? Well, bear in mind that both Koch brothers are

numbered among the 10 wealthiest Americans, and so are four Walmart

heirs. Great wealth buys great political influence — and not just

through campaign contributions. Many conservatives live inside an

intellectual bubble of think tanks and captive media that is ultimately

financed by a handful of megadonors. Not surprisingly, those inside the

bubble tend to assume, instinctively, that what is good for oligarchs is

good for America.

As

I’ve already suggested, the results can sometimes seem comical. The

important point to remember, however, is that the people inside the

bubble have a lot of power, which they wield on behalf of their patrons.

And the drift toward oligarchy continues.

Sunday, March 23, 2014

Friday, March 21, 2014

The Timidity Trap

Here's the latest column from Dr. Krugman - please read. Follow link to orignal.

------------------------------------------------------------------------------

http://www.nytimes.com/2014/03/21/opinion/krugman-the-timidity-trap.html?ref=paulkrugman&_r=0

------------------------------------------------------------------------------

http://www.nytimes.com/2014/03/21/opinion/krugman-the-timidity-trap.html?ref=paulkrugman&_r=0

There

don’t seem to be any major economic crises underway right this moment,

and policy makers in many places are patting themselves on the back. In

Europe, for example, they’re crowing about Spain’s recovery: the country seems set to grow at least twice as fast this year as previously forecast.

Unfortunately, that means growth of 1 percent, versus 0.5 percent, in a deeply depressed economy with 55 percent youth unemployment.

The fact that this can be considered good news just goes to show how

accustomed we’ve grown to terrible economic conditions. We’re doing

worse than anyone could have imagined a few years ago, yet people seem

increasingly to be accepting this miserable situation as the new normal.

How

did this happen? There were multiple reasons, of course. But I’ve been

thinking about this question a lot lately, in part because I’ve been

asked to discuss a new assessment of Japan’s efforts to break out of its deflation trap.

And I’d argue that an important source of failure was what I’ve taken

to calling the timidity trap — the consistent tendency of policy makers

who have the right ideas in principle to go for half-measures in

practice, and the way this timidity ends up backfiring, politically and

even economically.

In other words, Yeats had it right: the best lack all conviction, while the worst are full of passionate intensity.

About

the worst: If you’ve been following economic debates these past few

years, you know that both America and Europe have powerful pain caucuses

— influential groups fiercely opposed to any policy that might put the

unemployed back to work. There are some important differences between

the U.S. and European pain caucuses, but both now have truly impressive

track records of being always wrong, never in doubt.

Thus,

in America, we have a faction both on Wall Street and in Congress that

has spent five years and more issuing lurid warnings about runaway

inflation and soaring interest rates. You might think that the failure

of any of these dire predictions to come true would inspire some second

thoughts, but, after all these years, the same people are still being

invited to testify, and are still saying the same things.

Meanwhile, in Europe, four years have passed since the Continent turned to harsh austerity programs.

The architects of these programs told us not to worry about adverse

impacts on jobs and growth — the economic effects would be positive,

because austerity would inspire confidence. Needless to say, the

confidence fairy never appeared, and the economic and social price has

been immense. But no matter: all the serious people say that the

beatings must continue until morale improves.

So what has been the response of the good guys?

For there are good guys out there, people who haven’t bought into the

notion that nothing can or should be done about mass unemployment. The

Obama administration’s heart — or, at any rate, its economic model — is

in the right place. The Federal Reserve has pushed back against the

springtime-for-Weimar, inflation-is-coming crowd. The International

Monetary Fund has put out research debunking claims that austerity is painless. But these good guys never seem willing to go all-in on their beliefs

For

there are good guys out there, people who haven’t bought into the

notion that nothing can or should be done.

The

classic example is the Obama stimulus, which was obviously underpowered

given the economy’s dire straits. That’s not 20/20 hindsight. Some of

us warned right from the beginning

that the plan would be inadequate — and that because it was being

oversold, the persistence of high unemployment would end up discrediting

the whole idea of stimulus in the public mind. And so it proved.

What’s not as well known is that the Fed has, in its own way, done the same thing. From the start, monetary officials ruled out

the kinds of monetary policies most likely to work — in particular,

anything that might signal a willingness to tolerate somewhat higher

inflation, at least temporarily. As a result, the policies they have

followed have fallen short of hopes, and ended up leaving the impression

that nothing much can be done.

And

the same may be true even in Japan — the case that motivated this

article. Japan has made a radical break with past policies, finally

adopting the kind of aggressive monetary stimulus Western economists have been urging for 15 years and more.

Yet there’s still a diffidence about the whole business, a tendency to

set things like inflation targets lower than the situation really

demands. And this increases the risk that Japan will fail to achieve

“liftoff” — that the boost it gets from the new policies won’t be enough

to really break free from deflation.

You

might ask why the good guys have been so timid, the bad guys so

self-confident. I suspect that the answer has a lot to do with class

interests. But that will have to be a subject for another column.

Thursday, March 20, 2014

"New Ladders Of Opportunity Into The Middle Class"

George Bush talked about "the ownership society". Obama talks about "new ladders of opportunity into the middle class".

Can someone please tell me what the real difference between these phrases is? Does either phrase say ANYTHING about greater equality? Does either one address the huge elephant in the room?

I think not. That's the unfortunate thing about our politics today. That's the unfortunate thing about our society today. We have forgotten all about "We The People". we have totally lost the egalitarian impulse. We no longer give a damn if children go hungry. We no longer give a damn if folks are homeless.

This, the richest society in HISTORY (or so they tell us) actually has people going hungry. People freezing to death because they are homeless -- and, we don't give a damn.

At the very same time our "conservatives" call themselves "Christians". They are "Christians" who ARE "the money changers". They worship MONEY. It isn't the idol they worship, it's the GOLD.

I think all these haters should be ashamed of themselves. Hate just for hates sake. Mean, narrow, evil people, judging everyone while never looking into themselves.

If they want to see "the anti-Christ" -- they need only look into a mirror.

By the way ---- how did that "ownership society" thingy work out?

Can someone please tell me what the real difference between these phrases is? Does either phrase say ANYTHING about greater equality? Does either one address the huge elephant in the room?

I think not. That's the unfortunate thing about our politics today. That's the unfortunate thing about our society today. We have forgotten all about "We The People". we have totally lost the egalitarian impulse. We no longer give a damn if children go hungry. We no longer give a damn if folks are homeless.

This, the richest society in HISTORY (or so they tell us) actually has people going hungry. People freezing to death because they are homeless -- and, we don't give a damn.

At the very same time our "conservatives" call themselves "Christians". They are "Christians" who ARE "the money changers". They worship MONEY. It isn't the idol they worship, it's the GOLD.

I think all these haters should be ashamed of themselves. Hate just for hates sake. Mean, narrow, evil people, judging everyone while never looking into themselves.

If they want to see "the anti-Christ" -- they need only look into a mirror.

By the way ---- how did that "ownership society" thingy work out?

Wednesday, March 19, 2014

Nasa-funded study: industrial civilisation headed for 'irreversible collapse'? Natural and social scientists develop new model of how 'perfect storm' of crises could unravel global system

let us hear some more do-nothing "happy happy" crap. O.K.?

Please follow link to original

-----------------------------------------------------------------

http://www.theguardian.com/environment/earth-insight/2014/mar/14/nasa-civilisation-irreversible-collapse-study-scientists

A new study sponsored by Nasa's Goddard Space Flight Center has highlighted the prospect that global industrial civilisation could collapse in coming decades due to unsustainable resource exploitation and increasingly unequal wealth distribution.

Noting that warnings of 'collapse' are often seen to be fringe or controversial, the study attempts to make sense of compelling historical data showing that "the process of rise-and-collapse is actually a recurrent cycle found throughout history." Cases of severe civilisational disruption due to "precipitous collapse - often lasting centuries - have been quite common."

The research project is based on a new cross-disciplinary 'Human And Nature DYnamical' (HANDY) model, led by applied mathematician Safa Motesharrei of the US National Science Foundation-supported National Socio-Environmental Synthesis Center, in association with a team of natural and social scientists. The study based on the HANDY model has been accepted for publication in the peer-reviewed Elsevier journal, Ecological Economics.

It finds that according to the historical record even advanced, complex civilisations are susceptible to collapse, raising questions about the sustainability of modern civilisation:

These factors can lead to collapse when they converge to generate two crucial social features: "the stretching of resources due to the strain placed on the ecological carrying capacity"; and "the economic stratification of society into Elites [rich] and Masses (or "Commoners") [poor]" These social phenomena have played "a central role in the character or in the process of the collapse," in all such cases over "the last five thousand years."

Currently, high levels of economic stratification are linked directly to overconsumption of resources, with "Elites" based largely in industrialised countries responsible for both:

Modelling a range of different scenarios, Motesharri and his colleagues conclude that under conditions "closely reflecting the reality of the world today... we find that collapse is difficult to avoid." In the first of these scenarios, civilisation:

In both scenarios, Elite wealth monopolies mean that they are buffered from the most "detrimental effects of the environmental collapse until much later than the Commoners", allowing them to "continue 'business as usual' despite the impending catastrophe." The same mechanism, they argue, could explain how "historical collapses were allowed to occur by elites who appear to be oblivious to the catastrophic trajectory (most clearly apparent in the Roman and Mayan cases)."

Applying this lesson to our contemporary predicament, the study warns that:

The two key solutions are to reduce economic inequality so as to ensure fairer distribution of resources, and to dramatically reduce resource consumption by relying on less intensive renewable resources and reducing population growth:

Although the study is largely theoretical, a number of other more empirically-focused studies - by KPMG and the UK Government Office of Science for instance - have warned that the convergence of food, water and energy crises could create a 'perfect storm' within about fifteen years. But these 'business as usual' forecasts could be very conservative.

Please follow link to original

-----------------------------------------------------------------

http://www.theguardian.com/environment/earth-insight/2014/mar/14/nasa-civilisation-irreversible-collapse-study-scientists

A new study sponsored by Nasa's Goddard Space Flight Center has highlighted the prospect that global industrial civilisation could collapse in coming decades due to unsustainable resource exploitation and increasingly unequal wealth distribution.

Noting that warnings of 'collapse' are often seen to be fringe or controversial, the study attempts to make sense of compelling historical data showing that "the process of rise-and-collapse is actually a recurrent cycle found throughout history." Cases of severe civilisational disruption due to "precipitous collapse - often lasting centuries - have been quite common."

The research project is based on a new cross-disciplinary 'Human And Nature DYnamical' (HANDY) model, led by applied mathematician Safa Motesharrei of the US National Science Foundation-supported National Socio-Environmental Synthesis Center, in association with a team of natural and social scientists. The study based on the HANDY model has been accepted for publication in the peer-reviewed Elsevier journal, Ecological Economics.

It finds that according to the historical record even advanced, complex civilisations are susceptible to collapse, raising questions about the sustainability of modern civilisation:

"The fall of the Roman Empire, and the equally (if not more) advanced Han, Mauryan, and Gupta Empires, as well as so many advanced Mesopotamian Empires, are all testimony to the fact that advanced, sophisticated, complex, and creative civilizations can be both fragile and impermanent."By investigating the human-nature dynamics of these past cases of collapse, the project identifies the most salient interrelated factors which explain civilisational decline, and which may help determine the risk of collapse today: namely, Population, Climate, Water, Agriculture, and Energy.

These factors can lead to collapse when they converge to generate two crucial social features: "the stretching of resources due to the strain placed on the ecological carrying capacity"; and "the economic stratification of society into Elites [rich] and Masses (or "Commoners") [poor]" These social phenomena have played "a central role in the character or in the process of the collapse," in all such cases over "the last five thousand years."

Currently, high levels of economic stratification are linked directly to overconsumption of resources, with "Elites" based largely in industrialised countries responsible for both:

"... accumulated surplus is not evenly distributed throughout society, but rather has been controlled by an elite. The mass of the population, while producing the wealth, is only allocated a small portion of it by elites, usually at or just above subsistence levels."The study challenges those who argue that technology will resolve these challenges by increasing efficiency:

"Technological change can raise the efficiency of resource use, but it also tends to raise both per capita resource consumption and the scale of resource extraction, so that, absent policy effects, the increases in consumption often compensate for the increased efficiency of resource use."Productivity increases in agriculture and industry over the last two centuries has come from "increased (rather than decreased) resource throughput," despite dramatic efficiency gains over the same period.

Modelling a range of different scenarios, Motesharri and his colleagues conclude that under conditions "closely reflecting the reality of the world today... we find that collapse is difficult to avoid." In the first of these scenarios, civilisation:

".... appears to be on a sustainable path for quite a long time, but even using an optimal depletion rate and starting with a very small number of Elites, the Elites eventually consume too much, resulting in a famine among Commoners that eventually causes the collapse of society. It is important to note that this Type-L collapse is due to an inequality-induced famine that causes a loss of workers, rather than a collapse of Nature."Another scenario focuses on the role of continued resource exploitation, finding that "with a larger depletion rate, the decline of the Commoners occurs faster, while the Elites are still thriving, but eventually the Commoners collapse completely, followed by the Elites."

In both scenarios, Elite wealth monopolies mean that they are buffered from the most "detrimental effects of the environmental collapse until much later than the Commoners", allowing them to "continue 'business as usual' despite the impending catastrophe." The same mechanism, they argue, could explain how "historical collapses were allowed to occur by elites who appear to be oblivious to the catastrophic trajectory (most clearly apparent in the Roman and Mayan cases)."

Applying this lesson to our contemporary predicament, the study warns that:

"While some members of society might raise the alarm that the system is moving towards an impending collapse and therefore advocate structural changes to society in order to avoid it, Elites and their supporters, who opposed making these changes, could point to the long sustainable trajectory 'so far' in support of doing nothing."However, the scientists point out that the worst-case scenarios are by no means inevitable, and suggest that appropriate policy and structural changes could avoid collapse, if not pave the way toward a more stable civilisation.

The two key solutions are to reduce economic inequality so as to ensure fairer distribution of resources, and to dramatically reduce resource consumption by relying on less intensive renewable resources and reducing population growth:

"Collapse can be avoided and population can reach equilibrium if the per capita rate of depletion of nature is reduced to a sustainable level, and if resources are distributed in a reasonably equitable fashion."The NASA-funded HANDY model offers a highly credible wake-up call to governments, corporations and business - and consumers - to recognise that 'business as usual' cannot be sustained, and that policy and structural changes are required immediately.

Although the study is largely theoretical, a number of other more empirically-focused studies - by KPMG and the UK Government Office of Science for instance - have warned that the convergence of food, water and energy crises could create a 'perfect storm' within about fifteen years. But these 'business as usual' forecasts could be very conservative.

Monday, March 17, 2014

Saturday, March 15, 2014

Friday, March 14, 2014

The “Paid-What-You’re-Worth” Myth

From Robert Reich - follow link to original.

------------------------------------------------------

http://robertreich.org/

It’s often assumed that people are paid what they’re worth. According to this logic, minimum wage workers aren’t worth more than the $7.25 an hour they now receive. If they were worth more, they’d earn more. Any attempt to force employers to pay them more will only kill jobs.

According to this same logic, CEOs of big companies are worth their giant compensation packages, now averaging 300 times pay of the typical American worker. They must be worth it or they wouldn’t be paid this much. Any attempt to limit their pay is fruitless because their pay will only take some other form.

"Paid-what-you’re-worth" is a dangerous myth.

Fifty years ago, when General Motors was the largest employer in America, the typical GM worker got paid $35 an hour in today’s dollars. Today, America’s largest employer is Walmart, and the typical Walmart workers earns $8.80 an hour.

Does this mean the typical GM employee a half-century ago was worth four times what today’s typical Walmart employee is worth? Not at all. Yes, that GM worker helped produce cars rather than retail sales. But he wasn’t much better educated or even that much more productive. He often hadn’t graduated from high school. And he worked on a slow-moving assembly line. Today’s Walmart worker is surrounded by digital gadgets — mobile inventory controls, instant checkout devices, retail search engines — making him or her quite productive.

The real difference is the GM worker a half-century ago had a strong union behind him that summoned the collective bargaining power of all autoworkers to get a substantial share of company revenues for its members. And because more than a third of workers across America belonged to a labor union, the bargains those unions struck with employers raised the wages and benefits of non-unionized workers as well. Non-union firms knew they’d be unionized if they didn’t come close to matching the union contracts.

Today’s Walmart workers don’t have a union to negotiate a better deal. They’re on their own. And because fewer than 7 percent of today’s private-sector workers are unionized, non-union employers across America don’t have to match union contracts. This puts unionized firms at a competitive disadvantage. The result has been a race to the bottom.

By the same token, today’s CEOs don’t rake in 300 times the pay of average workers because they’re “worth” it. They get these humongous pay packages because they appoint the compensation committees on their boards that decide executive pay. Or their boards don’t want to be seen by investors as having hired a “second-string” CEO who’s paid less than the CEOs of their major competitors. Either way, the result has been a race to the top.

If you still believe people are paid what they’re worth, take a look at Wall Street bonuses. Last year’s average bonus was up 15 percent over the year before, to more than $164,000. It was the largest average Wall Street bonus since the 2008 financial crisis and the third highest on record, according to New York’s state comptroller. Remember, we’re talking bonuses, above and beyond salaries.

All told, the Street paid out a whopping $26.7 billion in bonuses last year.

Are Wall Street bankers really worth it? Not if you figure in the hidden subsidy flowing to the big Wall Street banks that ever since the bailout of 2008 have been considered too big to fail.

People who park their savings in these banks accept a lower interest rate on deposits or loans than they require from America’s smaller banks. That’s because smaller banks are riskier places to park money. Unlike the big banks, the smaller ones won’t be bailed out if they get into trouble.

This hidden subsidy gives Wall Street banks a competitive advantage over the smaller banks, which means Wall Street makes more money. And as their profits grow, the big banks keep getting bigger.

How large is this hidden subsidy? Two researchers, Kenichi Ueda of the International Monetary Fund and Beatrice Weder di Mauro of the University of Mainz, have calculated it’s about eight tenths of a percentage point.

This may not sound like much but multiply it by the total amount of money parked in the ten biggest Wall Street banks and you get a huge amount — roughly $83 billion a year.

Recall that the Street paid out $26.7 billion in bonuses last year. You don’t have to be a rocket scientist or even a Wall Street banker to see that the hidden subsidy the Wall Street banks enjoy because they’re too big to fail is about three times what Wall Street paid out in bonuses.

Without the subsidy, no bonus pool.

By the way, the lion’s share of that subsidy ($64 billion a year) goes to the top five banks — JPMorgan, Bank of America, Citigroup, Wells Fargo. and Goldman Sachs. This amount just about equals these banks’ typical annual profits. In other words, take away the subsidy and not only does the bonus pool disappear, but so do all the profits.

The reason Wall Street bankers got fat paychecks plus a total of $26.7 billion in bonuses last year wasn’t because they worked so much harder or were so much more clever or insightful than most other Americans. They cleaned up because they happen to work in institutions — big Wall Street banks — that hold a privileged place in the American political economy.

And why, exactly, do these institutions continue to have such privileges? Why hasn’t Congress used the antitrust laws to cut them down to size so they’re not too big to fail, or at least taxed away their hidden subsidy (which, after all, results from their taxpayer-financed bailout)?

Perhaps it’s because Wall Street also accounts for a large proportion of campaign donations to major candidates for Congress and the presidency of both parties.

America’s low-wage workers don’t have privileged positions. They work very hard — many holding down two or more jobs. But they can’t afford to make major campaign contributions and they have no political clout.

According to the Institute for Policy Studies, the $26.7 billion of bonuses Wall Street banks paid out last year would be enough to more than double the pay of every one of America’s 1,085,000 full-time minimum wage workers.

The remainder of the $83 billion of hidden subsidy going to those same banks would almost be enough to double what the government now provides low-wage workers in the form of wage subsidies under the Earned Income Tax Credit.

But I don’t expect Congress to make these sorts of adjustments any time soon.

The “paid-what-your-worth” argument is fundamentally misleading because it ignores power, overlooks institutions, and disregards politics. As such, it lures the unsuspecting into thinking nothing whatever should be done to change what people are paid, because nothing can be done.

Don’t buy it.

------------------------------------------------------

http://robertreich.org/

It’s often assumed that people are paid what they’re worth. According to this logic, minimum wage workers aren’t worth more than the $7.25 an hour they now receive. If they were worth more, they’d earn more. Any attempt to force employers to pay them more will only kill jobs.

According to this same logic, CEOs of big companies are worth their giant compensation packages, now averaging 300 times pay of the typical American worker. They must be worth it or they wouldn’t be paid this much. Any attempt to limit their pay is fruitless because their pay will only take some other form.

"Paid-what-you’re-worth" is a dangerous myth.

Fifty years ago, when General Motors was the largest employer in America, the typical GM worker got paid $35 an hour in today’s dollars. Today, America’s largest employer is Walmart, and the typical Walmart workers earns $8.80 an hour.

Does this mean the typical GM employee a half-century ago was worth four times what today’s typical Walmart employee is worth? Not at all. Yes, that GM worker helped produce cars rather than retail sales. But he wasn’t much better educated or even that much more productive. He often hadn’t graduated from high school. And he worked on a slow-moving assembly line. Today’s Walmart worker is surrounded by digital gadgets — mobile inventory controls, instant checkout devices, retail search engines — making him or her quite productive.

The real difference is the GM worker a half-century ago had a strong union behind him that summoned the collective bargaining power of all autoworkers to get a substantial share of company revenues for its members. And because more than a third of workers across America belonged to a labor union, the bargains those unions struck with employers raised the wages and benefits of non-unionized workers as well. Non-union firms knew they’d be unionized if they didn’t come close to matching the union contracts.

Today’s Walmart workers don’t have a union to negotiate a better deal. They’re on their own. And because fewer than 7 percent of today’s private-sector workers are unionized, non-union employers across America don’t have to match union contracts. This puts unionized firms at a competitive disadvantage. The result has been a race to the bottom.

By the same token, today’s CEOs don’t rake in 300 times the pay of average workers because they’re “worth” it. They get these humongous pay packages because they appoint the compensation committees on their boards that decide executive pay. Or their boards don’t want to be seen by investors as having hired a “second-string” CEO who’s paid less than the CEOs of their major competitors. Either way, the result has been a race to the top.

If you still believe people are paid what they’re worth, take a look at Wall Street bonuses. Last year’s average bonus was up 15 percent over the year before, to more than $164,000. It was the largest average Wall Street bonus since the 2008 financial crisis and the third highest on record, according to New York’s state comptroller. Remember, we’re talking bonuses, above and beyond salaries.

All told, the Street paid out a whopping $26.7 billion in bonuses last year.

Are Wall Street bankers really worth it? Not if you figure in the hidden subsidy flowing to the big Wall Street banks that ever since the bailout of 2008 have been considered too big to fail.

People who park their savings in these banks accept a lower interest rate on deposits or loans than they require from America’s smaller banks. That’s because smaller banks are riskier places to park money. Unlike the big banks, the smaller ones won’t be bailed out if they get into trouble.

This hidden subsidy gives Wall Street banks a competitive advantage over the smaller banks, which means Wall Street makes more money. And as their profits grow, the big banks keep getting bigger.

How large is this hidden subsidy? Two researchers, Kenichi Ueda of the International Monetary Fund and Beatrice Weder di Mauro of the University of Mainz, have calculated it’s about eight tenths of a percentage point.

This may not sound like much but multiply it by the total amount of money parked in the ten biggest Wall Street banks and you get a huge amount — roughly $83 billion a year.

Recall that the Street paid out $26.7 billion in bonuses last year. You don’t have to be a rocket scientist or even a Wall Street banker to see that the hidden subsidy the Wall Street banks enjoy because they’re too big to fail is about three times what Wall Street paid out in bonuses.

Without the subsidy, no bonus pool.

By the way, the lion’s share of that subsidy ($64 billion a year) goes to the top five banks — JPMorgan, Bank of America, Citigroup, Wells Fargo. and Goldman Sachs. This amount just about equals these banks’ typical annual profits. In other words, take away the subsidy and not only does the bonus pool disappear, but so do all the profits.

The reason Wall Street bankers got fat paychecks plus a total of $26.7 billion in bonuses last year wasn’t because they worked so much harder or were so much more clever or insightful than most other Americans. They cleaned up because they happen to work in institutions — big Wall Street banks — that hold a privileged place in the American political economy.

And why, exactly, do these institutions continue to have such privileges? Why hasn’t Congress used the antitrust laws to cut them down to size so they’re not too big to fail, or at least taxed away their hidden subsidy (which, after all, results from their taxpayer-financed bailout)?

Perhaps it’s because Wall Street also accounts for a large proportion of campaign donations to major candidates for Congress and the presidency of both parties.

America’s low-wage workers don’t have privileged positions. They work very hard — many holding down two or more jobs. But they can’t afford to make major campaign contributions and they have no political clout.

According to the Institute for Policy Studies, the $26.7 billion of bonuses Wall Street banks paid out last year would be enough to more than double the pay of every one of America’s 1,085,000 full-time minimum wage workers.

The remainder of the $83 billion of hidden subsidy going to those same banks would almost be enough to double what the government now provides low-wage workers in the form of wage subsidies under the Earned Income Tax Credit.

But I don’t expect Congress to make these sorts of adjustments any time soon.

The “paid-what-your-worth” argument is fundamentally misleading because it ignores power, overlooks institutions, and disregards politics. As such, it lures the unsuspecting into thinking nothing whatever should be done to change what people are paid, because nothing can be done.

Don’t buy it.

Thursday, March 13, 2014

DONALD BYRD, Slow Drag (Byrd)

Opening title track from Donald Byrd's "Slow Drag" album, recorded at the Van Gelder studios, Englewood Cliffs, NJ, at may 12, 1967. Donald Byrd (t); Sonny Red (as); Cedar Walton (p); Walter Booker (b); Billy Higgins (d, vc).

Donald Byrd & Pepper Adams Quintet ft. Herbie Hancock - Curro's

Donald Byrd - trumpet

Pepper Adams - baritone saxophone

Herbie Hancock - piano

Laymon Jackson - bass

Jimmy Cobb - drums

Philly Joe Jones Septet 1959 ~ Joe's Debut

Personnel:

Bill Barron - Tenor Sax

Pepper Adams - Baritone Sax

Blue Mitchell - Trumpet

Julian Priester - Trombone

Sonny Clark - Piano

Jimmy Garrison - Bass

Philly Joe Jones - Drums

Charlie Parker - Tiny Grimes Quintet 1944 ~ Tiny's Tempo ( Take 3 )

Personnel:

Charlie Parker - Alto Sax

Clyde Hart - Piano

Lloyd "Tiny" Grimes - Guitar

Jimmy Butts - Bass

Harold "Doc" West - Drums

Charlie Parker - Dizzy Gillespie Quintet Live 1947 ~ Koko

Personnel:

Charlie Parker - Alto Sax

J.B. "Dizzy" Gillespie - Trumpet

John Lewis - Piano

Al McKibbon - Bass

Joe Harris - Drums

Dizzy Gillespie and Charlie Parker-Dizzy Atmosphere

Dizzy Gillespie (tp) Charlie Parker (as) Clyde Hart (p) Remo Palmieri (g) Slam Stewart (b) Cozy Cole (d)

NYC, February 28, 1945

Brew Moore Quintet 1957 ~ Pat's Batch

)

Personnel:

Brew Moore - Tenor Sax

Harold Wylie - Tenor Sax

John Marabuto - Piano

John Mosher - Bass

John Markham - Drums

Personnel:

Brew Moore - Tenor Sax

Harold Wylie - Tenor Sax

John Marabuto - Piano

John Mosher - Bass

John Markham - Drums

Wednesday, March 12, 2014

Huey Long: Share the Wealth

I was told he was a "demagogue". I guess all the rich folks thought it.

Heck, today we begrudge folks food, shelter, health care, and freedom. We'd have them go naked if the "Christians" didn't think it immoral.

What has happened to my country?

---------------------------------------------------------------------

)

Heck, today we begrudge folks food, shelter, health care, and freedom. We'd have them go naked if the "Christians" didn't think it immoral.

What has happened to my country?

---------------------------------------------------------------------

)

Monday, March 10, 2014

Sunday, March 9, 2014

Friday, March 7, 2014

A story too good to check: Paul Ryan and the tale of the brown paper bag By Glenn Kessler March 6 at 10:07 pm

This from "The Fact Checker" - please follow link to original

-----------------------------------------

http://www.washingtonpost.com/blogs/fact-checker/wp/2014/03/06/a-story-too-good-to-check-paul-ryan-and-the-story-of-the-brown-paper-bag/?hpid=z3

“The left is making a big mistake here. What they’re offering people is a full stomach and an empty soul. The American people want more than that. This reminds me of a story I heard from Eloise Anderson. She serves in the cabinet of my buddy, Governor Scott Walker. She once met a young boy from a very poor family, and every day at school, he would get a free lunch from a government program. He told Eloise he didn’t want a free lunch. He wanted his own lunch, one in a brown-paper bag just like the other kids. He wanted one, he said, because he knew a kid with a brown-paper bag had someone who cared for him. This is what the left does not understand.”

– Rep. Paul Ryan (R-Wis.), speech to the Conservative Political Action Conference, March 6, 2014

This was an interesting statement made by the 2012 GOP vice-presidential candidate, equating school lunches to an “empty soul.” So one would think the anecdote, described by the National Review as “moving,” would be rock-solid. But the story seemed a bit pat.

Did Eloise Anderson, secretary of the Wisconsin Department of Children and Families, ever meet such a child?

Anderson responded:

But the story doesn’t end there. Wonkette, a satiric blog, wondered if Anderson’s story was actually derived from a 2011 book titled “The Invisible Thread,” by Laura Schroff, which is a book about a busy executive and her relationship with an 11-year-old homeless panhandler named Maurice Mazyck. His mother was a drug addict, in jail, who had stolen things and cashed in food stamps to pay for drugs. At one point, Schroff offers to bring Mazyck lunch every day so he won’t go hungry. The exchange goes like this:

“Look, Maurice, I don’t want you out there hungry on the nights I don’t see you, so this is what we can do. I can either give you some money for the week – and you’ll have to be really careful about how you spend it – or when you come over on Monday night we can go to the supermarket and I can buy all the things you like to eat and make you lunch for the week. I’ll leave it with the doormen, and you can pick it up on the way to school.”

Maurice looked at me and asked me a question.

“If you make me lunch,” he said, “will you put it in a brown paper bag?”

I didn’t really understand the question. “Do you want it in a brown paper bag?” I asked. “Or how would you prefer it?”

“Miss Laura,” he said, “I don’t want your money. I want my lunch in a brown paper bag.”

“Okay, sure. But why do you want it in a bag?”

“Because when I see kids come to school with their lunch in a paper bag, that means someone cares about them. Miss Laura, can I please have my lunch in a paper bag?”

This actually seemed a little strange. Could the tale told in congressional testimony really be drawn from a book? It did not make much sense in part because Schroff and Mazyck are partnering with a group called No Kid Hungry to help end childhood hunger in the United States. One key part of the program is connecting hungry kids with federal programs such as school lunches and food stamps. The group also opposed Ryan’s 2013 budget for its proposed reductions in the food stamp program.

So we asked Anderson when she met this boy and heard his story. Joe Scialfa, communications director for the department provided us with this answer:

Kevin Seifert, a spokesman for Ryan, said: “It’s unfortunate to learn that while testifying before the House Budget Committee, Secretary Anderson misspoke, but we appreciate her taking the time to share her insights.” After our inquiry, Ryan posted a notice on Facebook saying, “I regret failing to verify the original source of the story.”

But what about Ryan? Should he get a pass because he heard this from a witness before Congress? It really depends on the circumstances. In this case, he referenced the story in a major speech. The burden always falls on the speaker, and we believe politicians need to check the facts in any prepared remarks.

In this case, apparently, the story was too good to check. We appreciate he is regretful now. But a simple inquiry would have determined that the person telling the story actually is an advocate for the federal programs that Ryan now claims leave people with “a full stomach and an empty soul.” So he also earns Four Pinocchios.

-----------------------------------------

http://www.washingtonpost.com/blogs/fact-checker/wp/2014/03/06/a-story-too-good-to-check-paul-ryan-and-the-story-of-the-brown-paper-bag/?hpid=z3

“The left is making a big mistake here. What they’re offering people is a full stomach and an empty soul. The American people want more than that. This reminds me of a story I heard from Eloise Anderson. She serves in the cabinet of my buddy, Governor Scott Walker. She once met a young boy from a very poor family, and every day at school, he would get a free lunch from a government program. He told Eloise he didn’t want a free lunch. He wanted his own lunch, one in a brown-paper bag just like the other kids. He wanted one, he said, because he knew a kid with a brown-paper bag had someone who cared for him. This is what the left does not understand.”

– Rep. Paul Ryan (R-Wis.), speech to the Conservative Political Action Conference, March 6, 2014

This was an interesting statement made by the 2012 GOP vice-presidential candidate, equating school lunches to an “empty soul.” So one would think the anecdote, described by the National Review as “moving,” would be rock-solid. But the story seemed a bit pat.

Did Eloise Anderson, secretary of the Wisconsin Department of Children and Families, ever meet such a child?

The Facts

The first thing we did was look for Eloise Anderson and stories about brown paper bags. We discovered a congressional hearing, held on July 31, 2013, and chaired by Ryan, at which Anderson testified, that focused on the War on Poverty. Ryan asked Anderson what should be done to make the food stamp program, also known as SNAP, work better.Anderson responded:

My thought has always been around the SNAP program even when it was called “food stamps” is, why do you have this program, school program, school breakfast, school lunch, school dinner, when do we start asking parents to be responsible for their children?Okay, so Anderson had testified about this boy, and claimed that she had spoken to him and realized that welfare programs were draining any sense of responsibility. As she put it, “If this kid tells me a brown bag was more important than a free lunch, we’ve missed the whole notion of parents being there for their children because we’ve taken over that responsibility.”

You know, a little boy told me once that what was important to him is that he didn’t want school lunch, he wanted a brown bag because the brown bag that he brought with his lunch in it meant that his mom cared about him. Just think what we have done. If this kid tells me a brown bag was more important than a free lunch, we’ve missed the whole notion of parents being there for their children because we’ve taken over that responsibility, and I think we need to be very careful about how we provide programs to families that don’t undermine families’ responsibilities.

But the story doesn’t end there. Wonkette, a satiric blog, wondered if Anderson’s story was actually derived from a 2011 book titled “The Invisible Thread,” by Laura Schroff, which is a book about a busy executive and her relationship with an 11-year-old homeless panhandler named Maurice Mazyck. His mother was a drug addict, in jail, who had stolen things and cashed in food stamps to pay for drugs. At one point, Schroff offers to bring Mazyck lunch every day so he won’t go hungry. The exchange goes like this:

“Look, Maurice, I don’t want you out there hungry on the nights I don’t see you, so this is what we can do. I can either give you some money for the week – and you’ll have to be really careful about how you spend it – or when you come over on Monday night we can go to the supermarket and I can buy all the things you like to eat and make you lunch for the week. I’ll leave it with the doormen, and you can pick it up on the way to school.”

Maurice looked at me and asked me a question.

“If you make me lunch,” he said, “will you put it in a brown paper bag?”

I didn’t really understand the question. “Do you want it in a brown paper bag?” I asked. “Or how would you prefer it?”

“Miss Laura,” he said, “I don’t want your money. I want my lunch in a brown paper bag.”

“Okay, sure. But why do you want it in a bag?”

“Because when I see kids come to school with their lunch in a paper bag, that means someone cares about them. Miss Laura, can I please have my lunch in a paper bag?”

This actually seemed a little strange. Could the tale told in congressional testimony really be drawn from a book? It did not make much sense in part because Schroff and Mazyck are partnering with a group called No Kid Hungry to help end childhood hunger in the United States. One key part of the program is connecting hungry kids with federal programs such as school lunches and food stamps. The group also opposed Ryan’s 2013 budget for its proposed reductions in the food stamp program.

So we asked Anderson when she met this boy and heard his story. Joe Scialfa, communications director for the department provided us with this answer:

In the course of giving live testimony, Secretary Anderson misspoke. What she had intended to say was the following:It’s important to note that there is no discussion in the book about the school lunch program, and we could find no interview with Mazyck in which he said that. He simply repeats the story as told in the book, without any larger political context about federal programs to help hungry children. Moreover, this incident happened more than 25 years ago; Mazyck is no longer a boy but in his late 30s.

“Once I heard someone say, ‘what was important to him as a boy was that he didn’t want school lunch, he wanted a brown bag because the brown bag that he brought with his lunch in it meant that his mom cared about him.”

Secretary Anderson was referring to a television interview which she had seen with Maurice Mazyck.

Kevin Seifert, a spokesman for Ryan, said: “It’s unfortunate to learn that while testifying before the House Budget Committee, Secretary Anderson misspoke, but we appreciate her taking the time to share her insights.” After our inquiry, Ryan posted a notice on Facebook saying, “I regret failing to verify the original source of the story.”

The Pinocchio Test

Here at The Fact Checker, we often deal with situations in which people misspeak. We certainly don’t try to play gotcha. But this is a different order of magnitude. Anderson, in congressional testimony, represented that she spoke to this child — and then ripped the tale out of its original context. That’s certainly worthy of Four Pinocchios.But what about Ryan? Should he get a pass because he heard this from a witness before Congress? It really depends on the circumstances. In this case, he referenced the story in a major speech. The burden always falls on the speaker, and we believe politicians need to check the facts in any prepared remarks.

In this case, apparently, the story was too good to check. We appreciate he is regretful now. But a simple inquiry would have determined that the person telling the story actually is an advocate for the federal programs that Ryan now claims leave people with “a full stomach and an empty soul.” So he also earns Four Pinocchios.

Four Pinocchios

Thursday, March 6, 2014

The Great U-Turn

This from Robert Reich - please follow link to origial

---------------------------------------------------------------

http://robertreich.org/

---------------------------------------------------------------

http://robertreich.org/

Do you recall a time in America when the income

of a single school teacher or baker or salesman or mechanic was enough

to buy a home, have two cars, and raise a family?

I remember. My father (who just celebrated his 100th birthday) earned enough for the rest of us to live comfortably. We weren’t rich but never felt poor, and our standard of living rose steadily through the 1950s and 1960s.

That used to be the norm. For three decades after World War II, America created the largest middle class the world had ever seen. During those years the earnings of the typical American worker doubled, just as the size of the American economy doubled. (Over the last thirty years, by contrast, the size of the economy doubled again but the earnings of the typical American went nowhere.)

In that earlier period, more than a third of all workers belonged to a trade union — giving average workers the bargaining power necessary to get a large and growing share of the large and growing economic pie. (Now, fewer than 7 percent of private-sector workers are unionized.)

Then, CEO pay then averaged about 20 times the pay of their typical worker (now it’s over 200 times).

In those years, the richest 1 percent took home 9 to 10 percent of total income (today the top 1 percent gets more than 20 percent).

Then, the tax rate on highest-income Americans never fell below 70 percent; under Dwight Eisenhower, a Republican, it was 91 percent. (Today the top tax rate is 39.6 percent.)

In those decades, tax revenues from the wealthy and the growing middle class were used to build the largest infrastructure project in our history, the Interstate Highway system. And to build the world’s largest and best system of free public education, and dramatically expand public higher education. (Since then, our infrastructure has been collapsing from deferred maintenance, our public schools have deteriorated, and higher education has become unaffordable to many.)

We didn’t stop there. We enacted the Civil Rights Act and Voting Rights Act to extend prosperity and participation to African-Americans; Medicare and Medicaid to provide health care to the poor and reduce poverty among America’s seniors; and the Environmental Protection Act to help save our planet.

And we made sure banking was boring.

It was a virtuous cycle. As the economy grew, we prospered together. And that broad-based prosperity enabled us to invest in our future, creating more and better jobs and a higher standard of living.

Then came the great U-turn, and for the last thirty years we’ve been heading in the opposite direction.

Why?

Some blame globalization and the loss of America’s manufacturing core. Others point to new technologies that replaced routine jobs with automated machinery, software, and robotics.

But if these were the culprits, they only raise a deeper question: Why didn’t we share the gains from globalization and technological advances more broadly? Why didn’t we invest them in superb schools, higher skills, a world-class infrastructure?

Others blame Ronald Reagan’s worship of the so-called “free market,” supply-side economics, and deregulation. But if these were responsible, why did we cling to these ideas for so long? Why are so many people still clinging to them?

Some others believe Americans became greedier and more selfish. But if that’s the explanation, why did our national character change so dramatically?

Perhaps the real problem is we forgot what we once achieved together.

The collective erasure of the memory of that prior system of broad-based prosperity is due partly to the failure of my generation to retain and pass on the values on which that system was based. It can also be understood as the greatest propaganda victory radical conservatism ever won.

We must restore our recollection. In seeking to repair what is broken, we don’t have to emulate another nation. We have only to emulate what we once had.

That we once achieved broad-based prosperity means we can achieve it again — not exactly the same way, of course, but in a new way fit for the twenty-first century and for future generations of Americans.

America’s great U-turn can be reversed. It is worth the fight.

I remember. My father (who just celebrated his 100th birthday) earned enough for the rest of us to live comfortably. We weren’t rich but never felt poor, and our standard of living rose steadily through the 1950s and 1960s.

That used to be the norm. For three decades after World War II, America created the largest middle class the world had ever seen. During those years the earnings of the typical American worker doubled, just as the size of the American economy doubled. (Over the last thirty years, by contrast, the size of the economy doubled again but the earnings of the typical American went nowhere.)

In that earlier period, more than a third of all workers belonged to a trade union — giving average workers the bargaining power necessary to get a large and growing share of the large and growing economic pie. (Now, fewer than 7 percent of private-sector workers are unionized.)

Then, CEO pay then averaged about 20 times the pay of their typical worker (now it’s over 200 times).

In those years, the richest 1 percent took home 9 to 10 percent of total income (today the top 1 percent gets more than 20 percent).

Then, the tax rate on highest-income Americans never fell below 70 percent; under Dwight Eisenhower, a Republican, it was 91 percent. (Today the top tax rate is 39.6 percent.)

In those decades, tax revenues from the wealthy and the growing middle class were used to build the largest infrastructure project in our history, the Interstate Highway system. And to build the world’s largest and best system of free public education, and dramatically expand public higher education. (Since then, our infrastructure has been collapsing from deferred maintenance, our public schools have deteriorated, and higher education has become unaffordable to many.)

We didn’t stop there. We enacted the Civil Rights Act and Voting Rights Act to extend prosperity and participation to African-Americans; Medicare and Medicaid to provide health care to the poor and reduce poverty among America’s seniors; and the Environmental Protection Act to help save our planet.

And we made sure banking was boring.

It was a virtuous cycle. As the economy grew, we prospered together. And that broad-based prosperity enabled us to invest in our future, creating more and better jobs and a higher standard of living.

Then came the great U-turn, and for the last thirty years we’ve been heading in the opposite direction.

Why?

Some blame globalization and the loss of America’s manufacturing core. Others point to new technologies that replaced routine jobs with automated machinery, software, and robotics.

But if these were the culprits, they only raise a deeper question: Why didn’t we share the gains from globalization and technological advances more broadly? Why didn’t we invest them in superb schools, higher skills, a world-class infrastructure?

Others blame Ronald Reagan’s worship of the so-called “free market,” supply-side economics, and deregulation. But if these were responsible, why did we cling to these ideas for so long? Why are so many people still clinging to them?

Some others believe Americans became greedier and more selfish. But if that’s the explanation, why did our national character change so dramatically?

Perhaps the real problem is we forgot what we once achieved together.

The collective erasure of the memory of that prior system of broad-based prosperity is due partly to the failure of my generation to retain and pass on the values on which that system was based. It can also be understood as the greatest propaganda victory radical conservatism ever won.

We must restore our recollection. In seeking to repair what is broken, we don’t have to emulate another nation. We have only to emulate what we once had.

That we once achieved broad-based prosperity means we can achieve it again — not exactly the same way, of course, but in a new way fit for the twenty-first century and for future generations of Americans.

America’s great U-turn can be reversed. It is worth the fight.

Let Them Eat Dignity

Another post from Dr. Krugman on poverty, Paul Ryan, and Republicans. Please follow link to original.

----------------------------------------------------------------

http://krugman.blogs.nytimes.com/

----------------------------------------------------------------

http://krugman.blogs.nytimes.com/

We’re getting reports about Paul Ryan’s

performance at CPAC, the big conservative gathering — and they’re

actually kind of awesome, in the worst way.

I mean, the caricature of Ryan and people

like him is that they treat the hardships of poverty as if they were

merely psychological, that they talk big about dignity while ignoring

the difficulty of getting essentials like food and health care. Well,

it’s not a caricature: Ryan says never mind having enough to eat, it’s about spirituality:

“The left is making a big mistake,” Ryan predicted. “What they’re offering people is a full stomach and an empty soul. People don’t just want a life of comfort. They want a life of dignity, they want a life of self determination.”

Um, yes, but how dignified can you be on an empty stomach? How much self-determination do you have?

And who is supposed to value dignity over having enough to eat? Children. Ryan tells an anecdote about one sad child:

“He told Eloise he didn’t want a free lunch. He wanted his own lunch, one in a brown-paper bag just like the other kids,” he continued. “He wanted one, he said, because he knew a kid with a brown-paper bag had someone who cared for him. This is what the left does not understand.”

And if the child’s mother can’t provide that lunch in a brown paper bag, then what?

The total failure to accept that the poor

face real physical hardship, that affluent politicians have no business

lecturing people having trouble buying food or having trouble paying for

health care about dignity, is just stunning.

Tuesday, March 4, 2014

The Real Poverty Trap

Here's an excerpt from Dr. Krugman's blog -- follow link to read the rest of it.

-----------------------------------------------------

http://krugman.blogs.nytimes.com/

-----------------------------------------------------

http://krugman.blogs.nytimes.com/

Earlier I noted that the new Ryan poverty

report makes some big claims about the poverty trap, and cites a lot of

research — but the research doesn’t actually support the claims. It occurs to me, however, that the whole Ryan approach is false in a deeper sense as well.

How so? Well, Ryan et al — conservatives in

general — claim to care deeply about opportunity, about giving those not

born into affluence the ability to rise. And they claim that their

hostility to welfare-state programs reflects their assessment that these

programs actually reduce opportunity, creating a poverty trap. As Ryan once put it,

we don’t want to turn the safety net into a hammock that lulls able-bodied people to lives of dependency and complacency, that drains them of their will and their incentive to make the most of their lives.

OK, do you notice the assumption here? It is

that reduced incentives to work mean reduced social mobility. Is there

any reason to believe this as a general proposition?

Now, as it happens the best available research

suggests that the programs Ryan most wants to slash — Medicaid and food

stamps — don’t even have large negative effects on work effort. There

is, however, some international evidence

that generous welfare states have an incentive effect: America has by

far the weakest safety net in the advanced world, and sure enough, the

American poor work much more than their counterparts abroad:. ....................................

A Post

We were in Waco over the last weekend. Every time I visit another city in Texas my belief that the DFW area is the garden spot in Texas is strengthened. Our Metroplex seems to have greater diversity than any single city. In addition our air tastes far better than that in Houston.

The trip down took about two hours. The trip back up Sunday eve took SEVEN hours of driving. Black ice, multiple accidents, drivers unable to cope with the conditions led to HELLISH driving conditins. We were lucky to get home in one piece.

Once we got close to Dallas conditions were much better. The freezing rain and snow had passed, and our very efficient road crews were able to get a handle on all the trouble areas.

It seems the TxDot crews -- you know those "overpaid", "lazy", "gubbment" workers do a far better job than those of the "quasi-private" folks at the NTTA, one of those things that warm the the cockles of conservatives hearts -- if they happen to have any.

Anyway, it was a non-productive weekend that ended with the "ride from hell" (TM applied for).

More coming soon.