This from "Naked Capitalism" -- I truly hope it's wrong. I hope Europe, the Euro, and the EU survive. A breakdown might well lead to a worldwide depression, with severe political ramifications.

Please follow link to original - and bookmark the site, if you have not already done that.

---------------------------------------------------------------------------

Europe’s black cygnets -- Posted by Lambert Strether

By Delusional Economics, who is horrified at the state of economic commentary in Australia and is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

Although the Greece default is the very obvious European black swan at the moment I thought it would be prudent to point out two other things happenning in Europe over the next 12 months that certainly have the potential for evolving from a cygnet into something bigger.

Elections

There a number of elections occurring across Europe over the next 12 months that have the potential to de-rail the current European status quo.

Greece itself is supposed to be having a national election in April which is adding to the current debacle. Greek party leaders have more than one eye on their electorates at the moment which means the bailout negotiations have politicking on top of all the other issues. The consensus appears to be that Greek politicians are playing to their electorates, but will fold at the last minute. The idea being that they will be able to say to their voters that they put up a strong fight, but will ultimately do what is demand by the rest of Europe. This is obviously a bet on a politician’s behaviour, so there is obvious downside risk.

Greece elections, however, are not the greatest concern in my mind. Greece will be defaulting in some form or another this year, the elections influence is simply a question of how ‘messy’ that default becomes.

Germany also has two state elections this year which are a chance for Merkel’s Christian Democrats to regain the national majority they lost last year. It is believed that the worry about these election result was the source of the recent hamstringing of Angela Merkel by Volker Kauder, the floor leader of her party.

Latest polls have Merkel’s popularity at a two year high, however the results of the next state election in Saarland , to be held on March 25, are anything but predictable given recent history.

Talks to form a grand coalition between the major parties in the German state of Saarland have broken down, with early regional elections due to be held instead. The poll would also have an impact at the national level.

Talks on a transitional government in the south-western German state of Saarland broke down on Thursday, almost two weeks after the regional coalition collapsed.

An early election will now be called after Christian Democrat (CDU) Saarland state premier Annegret Kramp-Karrenbauer and her center-left Social Democrat (SPD) counterpart failed to reach agreement on a new temporary administration.

The election means that Chancellor Angela Merkel’s coalition now faces a second potentially damaging political test this year.

Following the Saarland election is another election on May 6 in the state of Schleswig-Holstein leading onto national elections in Autumn 2013. If Merkel’s party is unsuccessful in the Saarland election then their will be significant pressure on her to re-assess her approach to European policy.

Although both the Greek and German elections do add to the already unpredictable outcomes in the EuroZone they are not the major political risk. That place is left to France with presidential elections to be held on April 22 (first round) and May 6 (second round). These elections are very quickly becoming Franco-German.

President Nicolas Sarkozy is not yet officially a candidate in the forthcoming French presidential election, but that hasn’t stopped German Chancellor Angela Merkel from backing him.

….

Hannelore Kraft, the SPD premier of North Rhine Westphalia, said that the SPD would in any case be backing Sarkozy’s likely rival for the post, the center-left Socialist Party’s Hollande. In the “family of European social democracy this has always been a matter of course,” she told the Rheinische Post newspaper

The cross-border campaigning has already begun with a number of German politicians claiming political interference and one going as far as to call a recent Merkozy interview a “rather embarrassing” affair. Given that, at this point, European nations are still supposed to be political separate one has to wonder exactly what is going on. But that answer is easy to find as soon as you hear the man who is currently Mr Sarkozy’s presidential front runner speak.

François Hollande has said that although he is supportive of reducing the French budget deficit, he opposes constitutional limited on government budgets. He also wants to lower the rate at which fiscal cutbacks are made and he wants additional commitments from the EU around promoting economic growth and jobs. As you can see from the video Mr Hollande has been actively attacking Merkozy on the handling of the crisis and given that Angela Merkel has been returning fire during interviews it is very difficult to see how a win by Mr Hollande isn’t going to lead to some serious complications for the current Franco-German centric Europe.

Something to watch.

Spain

Although a default in Greece is likely to be disruptive, with direct contagion into Cyprus and market contagion in Portugal, the event is well known. Portugal itself is also a problem, but again this event it known and bond yields are reflective of the situation. In the scheme of things Portugal and Greece are relatively small and, although I think the market is underestimating the fallout, Europe is working on mechanisms that could potentially deal with the two countries along with Ireland. Italy is also a problem, but as I have explained previously Italy’s issue is growth more than debt so the country already has the potential to right itself.

That leaves Spain which I consider to be the major unrecognised problem. The country has seen its yields tumble since December on the back of the ECB’s 3-year LTRO but there hasn’t been anything in the economic metrics of the country to support such action. Spain has 23% unemployment and still rising, the banking system is under-capitalised and still has unknown exposure to the country’s housing market collapse. On top of that the rising unemployment rates is pushing up bad loans in the banking system to 7.4%, a 17-year high, and is still rising.

The country is also showing the same well known signs of what happens when you attempt government austerity when the private sector is attempting to deleverage without surplus in the external sector.

Unemployment has sky-rocketed since 2007

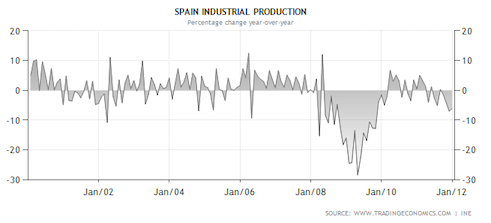

Industrial production is falling

Internal demand is falling as unemployment and a private sector credit demand collapses

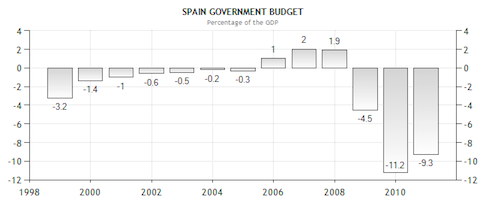

which ultimately leads to falling government revenues even as they are attempting austerity budgeting.

The Spanish government has already injected 30 billion euros into the banking system, but more is required and the government has suggested the banks need additional provisions of 50 billion Euros. As the data shows, this is is not a country that is on a sustainable path to recovery as the economy appears to be rapidly deflating. However, as I noted back in November, the new government of Mariano Rajoy doesn’t seem to have any plans outside of continuing austerity based policy.

There is no back-up mechanism in Europe big enough to save Spain which is why it is a concern to me that the financial markets don’t appear to have fully recognised the risk associated with the country.

This is the End and a New Beginning

-

I've been thinking about this for some time.

After 21 years of writing this blog almost daily, I've decided to stop

writing the daily updates on the blog.

...

5 weeks ago

No comments:

Post a Comment