This from "Economic Populist" -- read this, then weep at the level of economic knowledge our "leaders" have. Most are dumb sacks of S#*t.

As usual, please follow link to original.

-------------------------------------------------------------------------

Debt Deal Delusions: Debt to Gross Domestic Product Ratio

The compromise "is a positive step toward reducing the future path of the deficit and the debt levels,” Steven Hess, senior credit officer at Moody’s in New York, said in a telephone interview yesterday. “We do think more needs to be done to ensure a reduction in the debt to GDP ratio, for example, going forward." Bloomberg, Aug 2 (Image: Okko Pyykko)

How many times have you read or heard about the magic numbers concerning the ratio of national debt to gross domestic product (GDP)? This was trotted out by both sides of the debt ceiling debate as a fact: if the debt-to-GDP ratio exceeds 90%, the results will be dire. Therefore, our current situation calls for a crisis reaction and extreme measures to get below the magic number.

The problems with this analysis and the underlying research were never examined. This crisis worked so well at diverting public attention away from the real budget problems, we can assume there will be more debt ceiling crises in the future. It is worth understanding the problems with this ratio and the reasons to view conclusions and subsequent actions based on it as specious

Robert J. Shiller debunked this assumption in a short article written during the debate. He is a professor of economics at Yale and co-author of the respected Case-Shiller Housing Price Index.

Shiller makes some important points debunking the value of the ratio.

1. The ratio confuses cause and effect, the predictor and outcome variables. That's the type of error that gets your thesis proposal tossed out at your initial presentation. It's terribly humiliating, I'm told, and something graduate students in all disciplines go to great lengths to avoid. Here's what Shiller says;

"There is also the issue of reverse causality. Debt-to-GDP ratios tend to increase for countries that are in economic trouble. If this is part of the reason that higher debt-to-GDP ratios correspond to lower economic growth, there is less reason to think that countries should avoid a higher ratio, as Keynesian theory implies that fiscal austerity would undermine, rather than boost, economic performance." Robert Shiller, Delusions and Debt July 21

The debt problem is defined as the measurement of the problem -- a 90% or greater debt-to-GDP ratio. This is like manipulating a thermometer to show a lower body temperature and expecting that the lower measurement will alleviate the physical symptoms of a severe fever. It is backwards reasoning, to say the least.

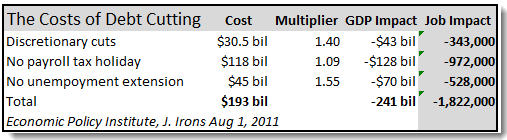

The outcome of this reverse causality, leading to austerity, is already projected. The final version of the bill just passed could cost up to 1.8 million jobs if only the following job killing cuts re put in place. From the Economic Policy Institute:

2. The Debt-to-GDP ratio is based on an arbitrary unit of time and, as such, makes no real sense. Shiller:

"Could it be that people think that a country becomes insolvent when its debt exceeds 100% of GDP?

"That would clearly be nonsense. After all, debt (which is measured in currency units) and GDP (which is measured in currency units per unit of time) yields a ratio in units of pure time. There is nothing special about using a year as that unit. A year is the time that it takes for the earth to orbit the sun, which, except for seasonal industries like agriculture, has no particular economic significance. Robert Shiller, Delusions and Debt July 21

Shiller points out that, in the case of Greece, if you "decadized" the debt over 40 years, the Debt-to-GDP ratio would be 15%, a figure the Greeks could be expected to pay. The conclusion that might be drawn from the analysis is that the crisis in Greece and the purported crisis in the United States are manufactured for the purposes of creating a crisis.

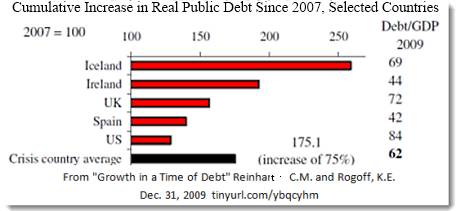

3. Shiller debunks the underlying analysis used to formulate the Debt-to-GDP ratio. The work announcing the 90% danger zone was by Reinhart and Rogoff, Growth in a Time of Debt, published at the end of 2009. This is supposedly the empirical basis for the 90% warning signal for dangers from Debt-to-GDP. Shiller points out:

" … Reinhart and Rogoff picked the 90% figure almost arbitrarily. They chose, without explanation, to divide debt-to-GDP ratios into the following categories: under 30%, 30-60%, 60-90%, and over 90%. And it turns out that growth rates decline in all of these categories as the debt-to-GDP ratio increases, only somewhat more in the last category." Robert Shiller, Delusions and Debt July 21

So we've had a debt crisis based, in large part, on a study that reversed causality, picked an arbitrary unit of time (one year) for the ratio used, and created arbitrary categories, including the magic 90% and above danger zone, where there were the differences in declining growth were not that remarkable. The reversed cause and effect mistake is enough to throw the entire theory out.

But if Professor Shiller's erudite analysis doesn't satisfy you, here's one more reason to reject the debt ratio argument. It excludes manipulation and bad judgment.

The study by Reinhart and Rogoff notes the following countries as having the worst Debt-to-GDP ratios. Shiller pointed out that the measure isn't the cause of the crisis rather, the crisis causes the ratio. In practical terms, fixing the ratio is not guaranteed to fix the underlying causes of the economic crisis.

A variation of the causality critique is obvious. Iceland, Ireland, and Spain were subject to various manipulations by internal and international finance. The governments of the UK and US were subject to and enablers of the same manipulations. The variable that's missing is outside manipulation and government complicity in that manipulation. Absent the machinations of Wall Street and the City of London, would any of these countries have the same Debt-to-GDP ratios?

Those brave enough to watch on C-Span have endured the ranting and fulminations of a bunch of male hysterics. So sure of themselves, so expert at everything, so willing to take the country down as low as it can go economically -- all for a set of cherished assumptions. This is one of them. We should thank Robert J. Shiller for calling it what is -- a delusion.

This is the End and a New Beginning

-

I've been thinking about this for some time.

After 21 years of writing this blog almost daily, I've decided to stop

writing the daily updates on the blog.

...

4 days ago

No comments:

Post a Comment